5 Steps to Write Investing Prompts That Actually Work

To deeply understand any business

Hello, Fellow Stock Pickers

If AI isn’t working for you as an investor, stop blaming ChatGPT.

The problem is your prompt.

Most investors make the mistake of writing a prompt in 30 seconds and expecting high-quality results.

But here’s the good news: writing a good prompt is simple.

Today, I’m sharing a 5-step formula to write prompts that actually work.

It helps me go from vague, generic answers to real, useful analysis.

I’ll show you how I used it to understand Planisware more clearly.

It’s a high-quality French SaaS company growing at 15% per year, valued at a 6% FCF yield.

Step 1: Define Exactly What You Want

A confused question gets a confused answer.

So start here: What do you actually want?

Ask yourself:

What result am I looking for?

What specific output do I expect?

How deep do I need to go right now?

Note: If all you need is a 15-page overview, use the global prompt I shared last time.

It’s perfect for big-picture understanding.But if you really want to go deeper, you need to follow this rule:

One prompt = One objective.

Let’s say you’re studying Planisware.

You’ve already used a general prompt to get the big picture. Good. That gives you context.

Now, you want to dig deeper but not everywhere. Just one thing:

“What’s the core business model?”

That’s a clear question. And it’s only one question.

Why does that matter?

Because when you combine multiple asks like:

“Explain the business model, analyze the last 10 years of data, analyse the IPO structure, and evaluate capital allocation for next 5 years”

you’re splitting the model’s attention.

Too many requests at once make it harder for AI to go deep or be precise on any of them.

Instead, break your learning into steps:

Start with the business model.

Then tackle capital allocation.

Then the financials.

One prompt. One objective. One deep answer.

Step 2: Write a first draft of your prompt

At this stage, we only care about understanding the business , nothing else.

And remember: we’re giving this prompt to DeepSearch, our unpaid analyst that will scrape 150+ sources and compile a full report for us.

So don’t overthink it. Don’t try to sound smart.

Just write what you want to understand in plain language.

Ask yourself:

When you say “understand the business,” what do you really mean for you ?

For me, it looks like this:

What’s the product?

What problem does it solve, and why does it matter?Who pays, and why?

Who are the customers? How painful is it to switch? Is it a must have?How does it make money?

Pricing model, revenue streams, margin profile.How does the sector work?

Key dynamics, players, and value chain.What exactly does the product do?

Explain it like you're the one selling it.What drives growth?

Pricing, upsell, market expansion, volume ?How is the company positioned?

What's the strategy? Who are the competitors? Where's the edge?

If you can answer all that, you don’t just know the company.

You understand the business. and that’s what i’m asking AI to search for me in details

Here’s what my raw draft prompt looks like:

I would like to understand in detail Planisware's business .

What’s the product? What problem does it solve, and why does it matter?

Who pays, and why? Who are the customers? How painful is it to switch? Is it a must-have?

How does it make money? Pricing model, revenue streams, margin profile.

How does the sector work? Key dynamics, players, and value chain.

What exactly does the product do? Explain it like you're the one selling it.

What drives growth? Pricing, upsell, market expansion, volume?

How is the company positioned? What’s the strategy? Who are the competitors? Where’s the edge?The prompt will be refined in the next step.

Step 3: Apply key best practices for clarity

Now that you have a rough draft, it’s time to refine it , so the AI gives you clear, useful answers instead of generic.

Here are some best practices I follow every time:

Set the context upfront

Example:

“You’re an expert analyst. Your job is to help me deeply understand the business model of Planisware as if I were acquiring it.”

This sets the tone and filters out surface-level answers.

Be ultra-specific

Vague prompts = vague answers.

Don’t just say “explain the company.” Ask for exact things you want to know.

dont use a vage sentance like “Tell me about the company” instead What exact problem does Planisware solve for its users?”

Specific inputs = relevant outputs. Think like you're briefing an intern.

Don’t overload the AI

AI has a short memory.

If your prompt is too long or asks too much at once, it starts forgetting or skipping parts.

This happens because most AI models have a token limit , but no need to get technical. Just know: long prompts get ignored, trimmed, or misunderstood.

Bad example (too long, repetitive):

“Can you explain what Planisware does, what its product features are, how those help customers, who those customers are, are the customers B2B or B2C, and is this enterprise helping them optimize cost?”

Better version (short, clear):

“What problem does Planisware solve, and for which customers?”

You need to find the right balance between giving enough detail and not overloading the AI

Step 4: Ask the AI to improve your prompt

Now that you’ve written a solid draft using best practices, it’s time to do what smart investors do: iterate.

And who better to help you refine your prompt… than AI itself?

Here’s the exact meta-prompt I use to improve my own prompts:

(Yes — I use AI to write better prompts for AI.)

You are an expert in prompt engineering.I’ll share a draft prompt I plan to use with DeepSearch.Your task: rewrite it to maximize clarity, structure, and effectiveness — so it produces deep, accurate, and well-organized responses.

Make sure to:Define the role and mission clearly

Break down complex asks into bullet points

Eliminate vague or redundant phrases

Keep it concise to stay within token limits

Output a clean, ready-to-use version of the improved prompt.Ready? Here’s the draft:xxxThis is the prompt it generated. Feel free to use it and if it helps, subscribing is the best way to say thanks.

You are a senior SaaS analyst and ex-operator.

TASK

Write a high-level, long-form analysis of **Planisware**, a French B2B SaaS company in Project & Portfolio Management (PPM).

Assume the reader is evaluating an acquisition or launching a direct competitor.

The report must match the depth and clarity of a McKinsey- or investor-grade memo.

OUTPUT

-Executive summary (≤150 words)

- Structured memo: one section per topic below

- Use concise paragraphs or bullet points

- No fluff, no speculation, no source list

RULES

- Use only public data

- If missing, estimate from close SaaS comps and explain briefly

- Every insight must support a strategic decision

SECTIONS

1. Product & Workflow

What does the product do?

What problem does it solve?

How critical is it in the workflow?

2.Customer Segments

Who buys it (sector, size, region)?

What triggers adoption?

What segments are over-/under-penetrated?

Any concentration risk

3. Revenue Model

Pricing logic (user/module/tiered)?

Recurring vs one-time revenue

Margin, churn, NRR, CAC, FCF profile

Working capital needs?

4.Competition & Market Dynamics

Who are the main competitors?

What differentiates Planisware (features, vertical depth, UX)?

What is the size and growth of the PPM market?

Is the market fragmented or consolidating?

Who holds pricing power?

Where does Planisware win or lose?

5. Go-to-Market & Delivery

Sales motion and cycle

Typical ACV

Implementation model (internal/partner)?

Bottlenecks

6. Growth & Strategy

Key growth levers (pricing, upsell, bundling, partners)

Long-term bets (AI, analytics, verticals)

Is the model scalable?

7. Risks & Tradeoffs

What has the company avoided and why?

Key risks to growth or margins?

Signs of fragility or misalignment

STYLE

- Clear, structured, and decision-oriented

- Bullet points only when they add claritySo, after all these steps, is the final prompt worth the effort?

Absolutely ! for two key reasons:

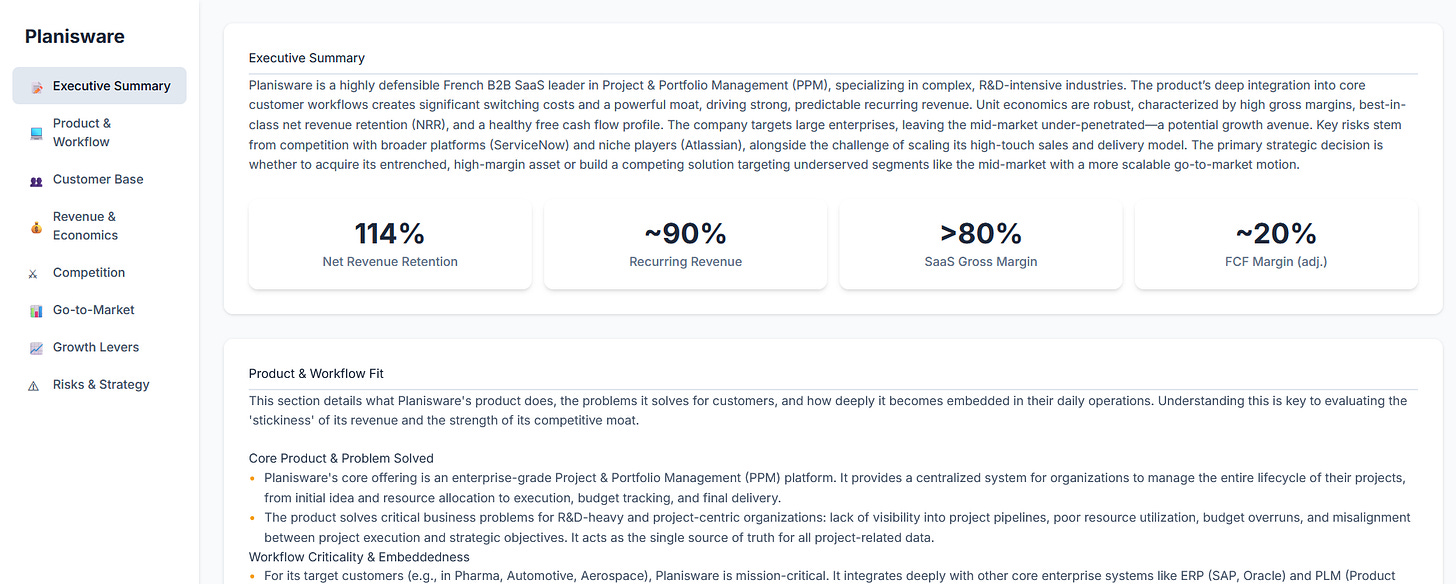

The output speaks for itself.

This isn’t a generic overview. It’s a real deep dive — clear, structured, and full of insights you can actually use. Take a look.

It’s reusable.

Once built, this kind of prompt becomes a strategic asset. You can adapt it to any company . Just tweak the inputs, and the structure does the heavy lifting.

Step 5: Treat the Prompt Like an Asset

Don’t throw away a decent prompt after one use.

Refine it.

Every time you get a report, take notes:

What was vague?

What was missing?

What would’ve made it sharper?

Make it better with every run.

Think of it like a free junior analyst, the more feedback you give it, the better it gets.

Start with one focused prompt (e.g. “Explain Planisware’s business model”).

Then reuse the same process for other layers of analysis:

Financials

Management background

Capital allocation

Also,you can generate clean, structured one-pagers in one click with Gemini.

This is how you build a repeatable research system with AI.

One prompt at a time.

Dude this is fantastic. I started using ChatGPT a few months ago for analysing companies as I don't have a background that understands businesses and balance sheets. The questions I've ask (and still do!) are very basic just to help me understand a surface research on companies. But what you've shown in your articles are just gold. I still won't be able to take it all in, but will have the know how to extract the most juice in the shortest time and hopefully dumb it down for me. That would be my prompt at the end!