Grow Your Circle of Competence (in 60 Minutes a Week)

Use AI as your research copilot

Hello, Fellow Stock Pickers

Everyone knows Buffett’s advice:

Only invest in businesses inside your circle of competence.

It’s a rule you can’t break.

Step outside it, and you risk big losses.

But there’s another danger: if you never expand the circle, your future opportunities stay small.

The smart move?

Keep investing only inside your circle and work in parallel to expand it.

I think every investor should dedicate time only to expanding their circle of competence.

No stock picking.

No rushing to buy.

Just learning.

But learning takes time…

The good news is that AI can compress the work. What once took weeks can now be done in hours.

In this newsletter, I’ll show you how to expand your circle of competence with only 60 minutes a week.

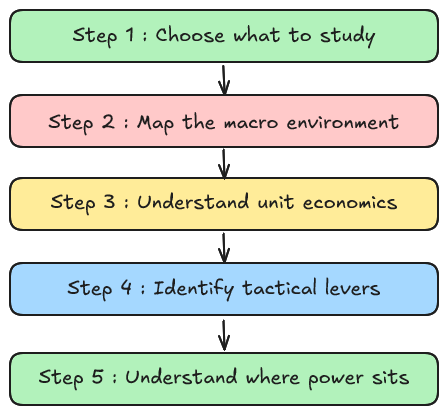

Here are the exact 5 steps to do it…

Step 1 : Choose what to study

Don’t try to “learn tech.” That’s too broad.

Take a pause, make a plan.

Split the sector into simple chunks, then pick just one to focus on this week.

How to start:

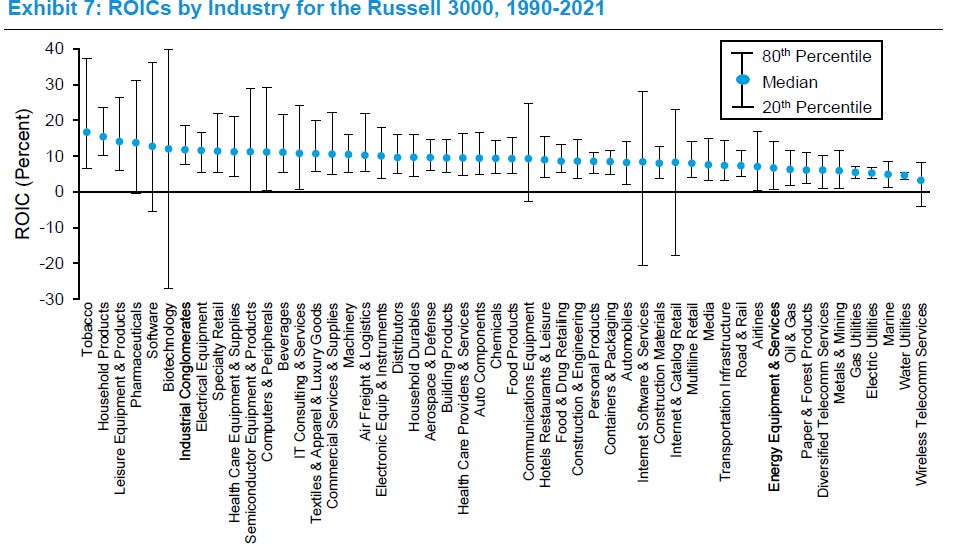

Look for “good fishing spots” :industries with historically strong, durable ROIC (Michael Mauboussin’s work is a great starting point).

But those categories are still vague. You need a clear breakdown before you can study.

Drop the prompt below into ChatGPT thinking model with any sector (example: IT Consulting & Services).

Review the buckets, then pick one as your focus for this week’s 60 minutes.

Copy this prompt Replace IT Consulting & Services with the sector you want to study:

ROLE: Sector expert analyst.

GOAL: I know nothing about “IT Consulting & Services.” Create a simple, practitioner-grade 4-bucket taxonomy (you choose the names) that covers the sector without overlap.

OUTPUT :

one block per bucket (bullet style):

- Name

- What it sells (1–2 lines)

- How it differs (1–2 line)

- What’s the business (how firms make money; typical work pattern/deal shapes in plain language)

- Why it’s its own category (1–2 lines; clear boundary vs the others)

- Players (2–3 PUBLIC examples with tickers; ≥1 US and ≥1 Europe)

RULES:

- Be MECE; no overlaps. No fluff.

- Practitioner-friendly buckets; avoid jargon (define acronyms on first use).Choose just one to start.

For example: in IT Consulting & Services, I’d focus on Advisory & Enterprise Transformation for the moment.

Don’t overthink this step. The real research comes next.

Your only goal here is to set a clear, narrow focus for this week’s 60 minutes.

Step 2 : Map the macro environment

You’ve chosen your sub-sector.

Now it’s time to zoom out and build a map of the industry as a whole.

Here’s what I like to check :

Market & structure : How big is the market? How fast is it growing over the next 3–5 years? Is it fragmented (many small players) or consolidated (few giants)?

Value chain & margin pools : Who sells to whom, and where are the stable profit pools?

Regulation & mega trends : What external forces shape demand? Think technology shifts, demographics, ESG, subsidies, tariffs.

Cyclicality drivers :Which cycles really matter here? Commodity prices, consumer demand, capex, credit. (Yes , everything is cyclical at the end of the day, the only question is how violently the cycle swings.)

Here’s a prompt you can use.

Just replace Consulting Advisory with your own sub-sector.

Make it yours.

This prompt is an asset , save it, re-use it, and build your own library of analysis tools.