How to Judge a CEO Without Reading 1,000 Pages

3 AI Steps to Spot Red Flags Before You Invest

Hello, Fellow Stock Pickers

Nothing destroys returns faster than a bad CEO.

Especially in small and mid-cap stocks.

Philip Fisher said it decades ago:

The most important thing in evaluating a company is the quality of its management

And he’s right.

The numbers can look fine.

The industry can look promising.

But if management is weak, you lose.

The problem? Most investors do one of two things:

spend weeks digging through filings, or

skip the work and just “trust” management.

Both are costly. One wastes time. The other risks capital.

The good news: AI will give a clear, structured view of a CEO fast

In 3 steps, you can quickly see:

Their track record : capital allocation and career history.

Promises vs. results :what they said vs. what actually happened.

Alignment :whether their incentives match yours.

It won’t replace your judgment.

But it will quickly show if a CEO deserves your time

or if the red flags say walk away.

It points you to where deeper research matters.

And trust me, AI is powerful for this:

Step 1: Build the CEO profile

Start with the CEO’s record: where they worked, what they did, and how they handled capital.

Think of IA as your private detective.

It pulls from filings, transcripts, and press, connecting promises, decisions, and outcomes.

(It can even dig into personal background if you want to go that far.)

Here’s how to do it in 5 minutes:

Copy the Prompt below.

Replace the CEO and company name.

Paste it directly into Gemini DeepSearch.

Get back a structured CEO Scorecard with an executive summary, evidence tables, and a clear verdict.

The CEO profile prompt (copy-paste, replace the name and company):

ROLE

Act as an analyst preparing a CEO due-diligence dossier for institutional investors.

Write in a consulting-report style: executive summary first, then structured sections with tables and bullet points.

Keep it factual and evidence-based. Do not speculate about personality or charisma.

INPUT

CEO = {{CEO Name}}

Company = {{Company Name}}

SOURCES (guidance, not strict order)

Official filings (annual reports, shareholder letters, SEC/AMF filings, proxy statements, insider filings).

Investor communications (earnings call transcripts, capital markets day presentations).

Reputable business media (FT, WSJ, Bloomberg, Reuters, Forbes, Fortune).

Professional bios (LinkedIn, company bio, official websites).

Watchdog/regulatory sources if relevant (NGOs, governance trackers, sanctions).

Social media posts only if directly tied to business reputation.

WHAT TO DELIVER (fixed structure)

Executive Summary

CEO Profile at a Glance (career highlights, ownership, expertise).

Synthesized Assessment: 2–3 key strengths, 2–3 material risks.

One-line Verdict: “Long-term steward” OR “Potential risk.”

Career Map & Expertise

Timeline of roles: Years | Company | Role | Sector | Notable contribution.

Classification: entrepreneur, operator, allocator (mark the dominant type).

Core expertise & skills, with real examples of impact.

Track Record of Decisions

Table: Date | Role | Major Decision (M&A, buyback, restructuring, expansion) | Outcome (value created/destroyed).

Identify visible patterns (disciplined allocator, empire-builder, turnaround operator).

Ownership & Alignment

Stock ownership (outright shares vs options/awards).

Insider buying/selling history.

Dilution/compensation impact.

Alignment rating: High / Medium / Low.

Governance, Candor & Risks

Evidence of candor vs spin in communications.

Media reputation (serious press).

Controversies, lawsuits, regulatory actions.

Short evidence table: Date | Source | Quote/Fact | Risk Level.

Final Assessment

3–4 bullets summarizing strengths and weaknesses.

Confidence rating: High / Medium / Low.

Clear conclusion: “This CEO shows evidence of disciplined stewardship” OR “This CEO poses material risks to long-term shareholders.”

RULES

Cover the entire CEO tenure in role.

Where possible, bring in long-term evidence (multi-year patterns, not just recent results).

Every claim must be tied to a specific event, number, or quote.

When possible, include the date + source (filing, article, transcript).

If no reliable source exists, explicitly write “Not disclosed” — never fabricate.

Keep writing concise, consulting-grade, and structured.

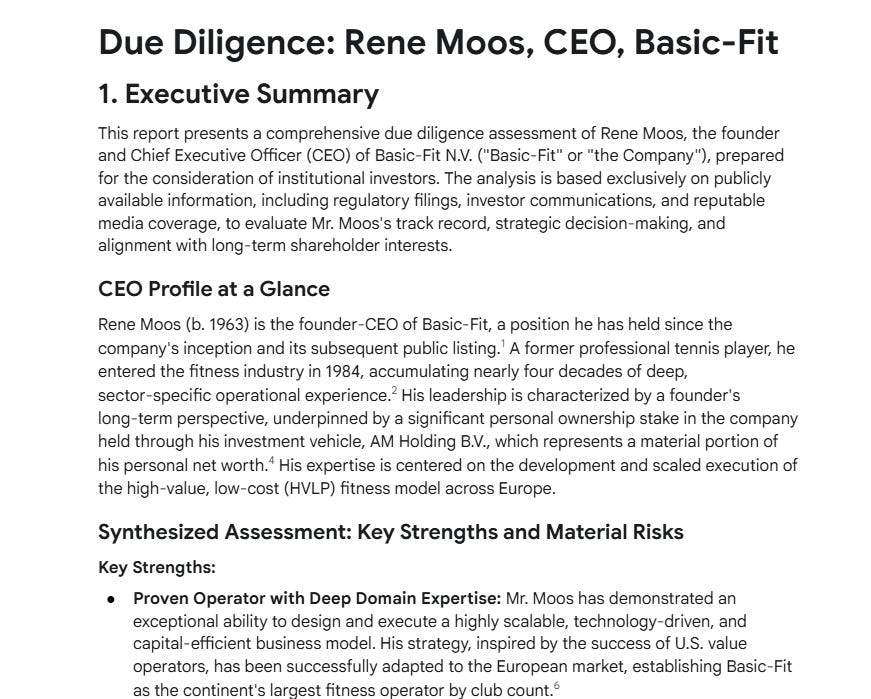

The result?

A 15–20 page report on the CEO’s entire history.

Global analysis you couldn’t produce in a week on your own.

I’ve done this work manually before.

It takes interviews, hours of digging, and even then it’s rarely this precise.

DeepSearch gets it right in minutes.

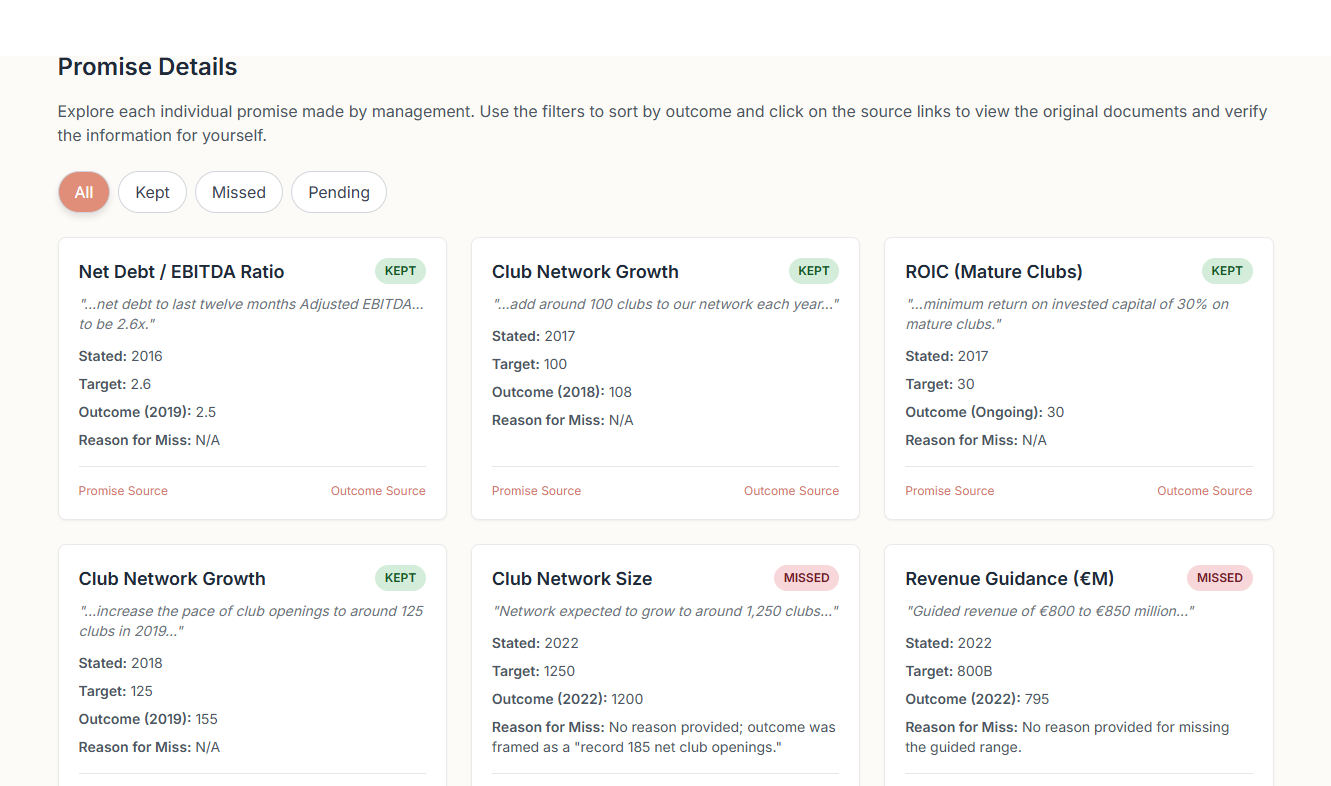

Step 2: Promises vs. Results

In Step 1, you built a global overview of the CEO’s history and background.

Now it’s time to test their credibility.

Every CEO makes promises.

Growth targets. Expansion plans. Margin goals.

But did they deliver?

DeepSearch makes it simple. It lines up what management said against what actually happened.

Here’s how to do it:

Copy the Prompt below.

Replace the CEO and company name.

Paste it into Gemini DeepSearch.

Steal this Prompt, tweak it, and make it yours.

ROLE

You are a long-term, owner-oriented investor.

Your task: verify what management promised, what happened, and whether they delivered.

Focus only on facts stated directly by management in official materials.

SOURCES

Annual reports (uploads provided).

Other primary company sources: SEC/EDGAR filings, official IR (press releases, investor-day decks, transcripts).

Transcripts/interviews: only if quotes come directly from management.

Exclude all secondary sources (media, blogs, analyst notes, wikis).

If citing an upload, also provide the nearest public primary link (URL or filing reference).

SCOPE

Company: {{COMPANY_NAME}}

Ticker: {{TICKER}}

Period: full CEO tenure (preferably 10+ years if available).

A “Promise” = quantifiable target + explicit or implied deadline.

Only include material promises relevant to shareholder value (leverage, ROIC/margins, buybacks/dividends, synergies, growth/expansion targets).

OUTPUT

Executive Summary (≤300 words)

Count of promises kept vs missed vs partial vs pending.

One factual credibility takeaway (no adjectives, no speculation).

Promise Timeline Table (Markdown required)

| Promise (metric + target) | Year stated — quote + source | Due year / Outcome evidence + source | Verdict (Kept / Missed / Partial / Pending) | If Missed: reason stated by management |

Quote length ≤30 words.

Every row must include at least one primary source citation (URL or filing ref).

Source Tally

Count number of rows per source type (Uploads / officiel filings / IR site).

RULES

Every claim must have a citation.

If evidence is missing, write “Not disclosed”.

No speculation, no commentary beyond facts.

Use Markdown tables only.

Deliver three blocks in order: Exec Summary → Promise Table → Source Tally.

The result?

A full report listing every past promise, what happened, and what was expected.

And here’s the best part: you don’t need to read it line by line.

With one click, Gemini can turn the report into an interactive web page, perfect for timelines and sequential analysis.

How to do it:

Open the DeepSearch report.

Click Create → Website.

Wait one minute.

You’ll get a clean, auto-generated page you can scroll like a dashboard like this one on basic fit:

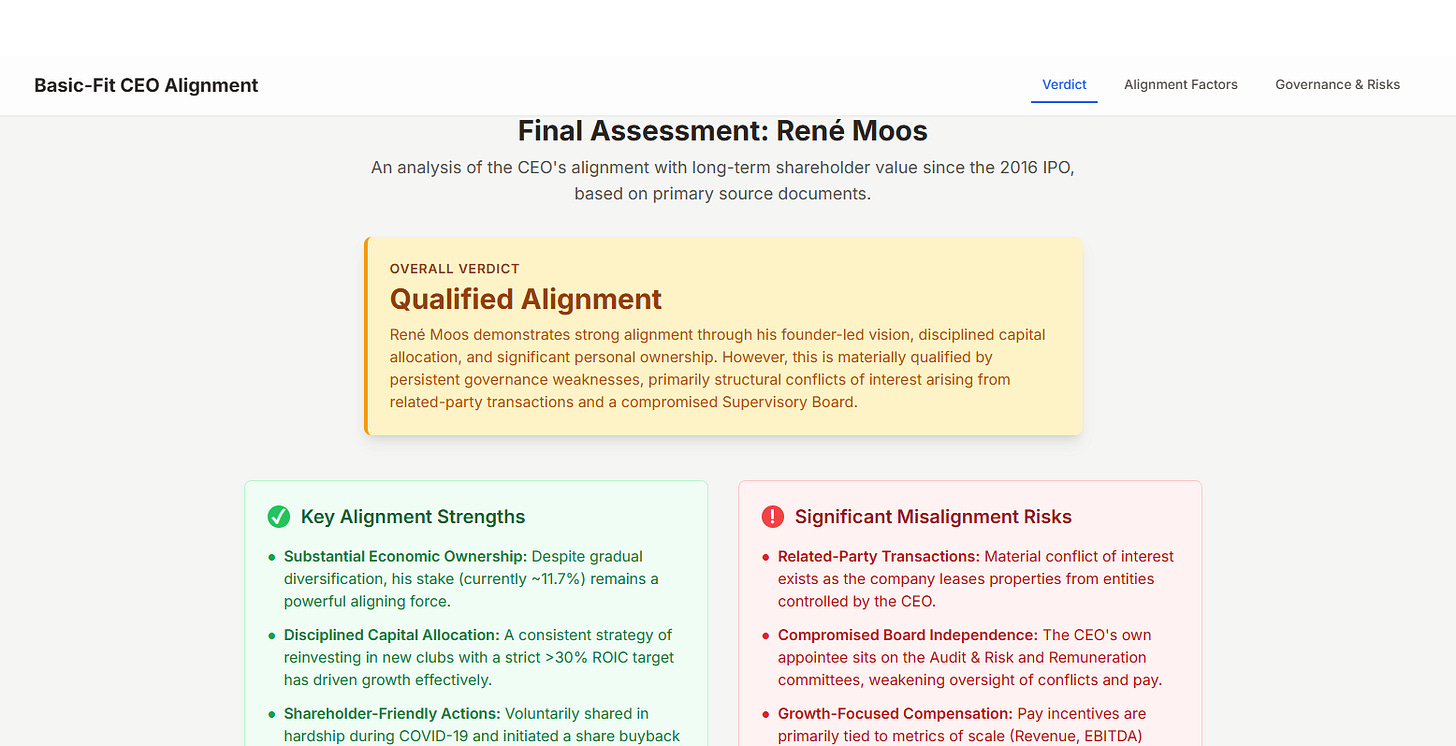

Step 3: Check Alignment

You’ve got the background.

You’ve tested credibility.

Now comes the final question: is the CEO aligned with you, the shareholder?

This is where most investors stop at “he owns stock.”

Not enough. Alignment runs deeper.

Here’s what i like to check:

Economic ownership : real shares vs. paper options.

Insider trading :buying when it matters, or quietly selling?

Related-party transactions :any disclosed deals or contracts where the CEO benefited at shareholder expense.

Governance & candor : do they admit mistakes, or just spin?

DeepSearch can pull all of this into one structured report so you see in minutes whether a CEO is playing for themselves or for you.

ROLE

You are a senior equity analyst writing for institutional investors.

Prepare a CEO/Shareholder Alignment Report: structured, evidence-based, consulting style.

INPUT

CEO: {{CEO_NAME}}

Company: {{COMPANY_NAME}}

SOURCES

Primary: annual reports, DEF 14A/AMF filings, insider filings.

Investor comms: transcripts, investor-day decks, IR releases.

Exclude secondary (media, blogs, wikis, analyst notes).

SCOPE

Cover full CEO tenure

OUTPUT

1. Executive Summary

CEO profile at a glance.

Alignment verdict (High / Medium / Low).

3 headline positives, 3 headline risks. if they exists

One-line conclusion: “This CEO is [aligned/misaligned/mixed] with long-term shareholder value.”

2. Methodology (Alignment Framework)

Explain the 7 categories used:

Economic Ownership

Compensation Alignment

Insider Trading Behavior

Dilution & Shareholder Treatment

Capital Allocation Discipline

Related-Party Transactions

Governance & Candor

Define verdicts: Aligned / Misaligned / Mixed.

Note: expand with historical narrative of CEO actions, promises, and outcomes across tenure.

3. Category Analysis (repeat for each of the 7 categories)

Format for each category:

Narrative Analysis:

Why it matters for shareholder alignment.

Context/history under this CEO.

Evidence drawn from filings/IR.

Evidence Table (Markdown):

| Date | Source | Fact/Quote | Impact on Shareholder Value |

Trend Analysis: how it evolved over CEO tenure.

Verdict: One word (Aligned / Misaligned / Mixed).

4. Cross-Sectional Patterns

Synthesize findings across categories.

Highlight consistencies/contradictions.

Identify overarching alignment theme.

5. Final Assessment

3 strongest alignment points.

3 biggest misalignment risks.

One bold conclusion sentence.

RULES

Every claim must carry a citation: [YYYY | Source | URL/page].

If evidence missing: write “Not disclosed.”

Concise but substantive.

Must be a report: headings, structured sections, tables.

Each section must add insight; no repetition or filler.

Identify contradictions (e.g., high ownership but excessive dilution).

Highlight overarching alignment theme.

Comparative Benchmarking

Where possible, compare CEO’s pay, ownership, dilution vs peers or sector medians.

Show whether alignment is above/below norms.

Final Assessment

3 bullets: strongest alignment factors.

3 bullets: biggest misalignment risks.

One bold conclusion line:

“This CEO is [aligned/misaligned/mixed] with long-term shareholder value.”

RULES

Every claim tied to a citation in this format: [YYYY | Source | URL/page].

If data is missing: write “Not disclosed.”

No speculation, no filler.

Each section must add insight; skip generic wording.

Depth is required, but only where evidence supports it.The result?

A clear verdict on whether the CEO is aligned with long-term shareholder value or not.

Your 3-Step CEO Scanner:

Build the Scorecard : their history, career map, and track record.

Test Promises vs. Results : what they said vs. what actually happened.

Check Alignment : ownership, insider trades, dilution and related-party deals.

The old way: weeks of digging.

The new way: DeepSearch + one prompt = answers in minutes.

That’s the real edge: AI doesn’t replace your judgment, but it gives you the map fast.

You decide if a CEO is a long-term steward, or a risk you should avoid.

If you enjoyed this breakdown, share it with another investor who cares about management quality.

And if you want more tools like this, make sure you’re subscribed because the next edition is coming soon.

Investing is hard enough. Don’t let a bad CEO make it harder.

Please inform how to copy the prompt from your post. You have disabled it. It can not be copied.

AI can surface patterns fast, but it won’t do the thinking for you. If you outsource judgment, you’ll just automate mistakes.