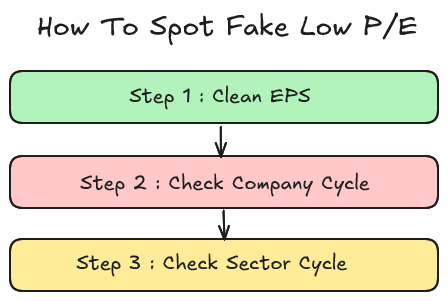

How To Spot Fake Low P/E With 3 Prompts

...And Avoid the -85% Loss

Hello, Fellow Stock Picker

Last week I came across a stock I had looked at 3 years ago.

Back then, it was trading at 6× P/E with net cash.

I spent a lot of time analyzing it but didn’t buy because it was cyclical.

Today the stock is down –85%.

I smiled, happy I hadn’t invested…

But I also felt frustrated, remembering how much time I had wasted on it.

That’s when it hit me. The risk isn’t just losing money.

It is also losing time on traps that look cheap but aren’t.

So I asked myself: how can AI help me avoid both?

Here is the framework I now use.

A way to test in whether a low P/E is real value or just noise :

Step 1 : Clean EPS Check

It’s a PE of 6 but Are the earnings real and repeatable?

GAAP earnings are messy.

One-offs, discontinued operations or tax tricks can all make EPS look better than it really is.It says P/E of 6. But are the earnings real and repeatable?

GAAP earnings are messy.

One-offs, discontinued operations, or tax tricks can all make EPS look better than it really is. Before you trust the P/E, you need to clean it.

Red flags to watch for:

“One-time” items that keep coming back

Clean EPS more than 10–15% below GAAP EPS

Effective tax rate much lower than the 5-year median

How to do it with AI

Use NotebookLM as the main tool.

Load the last 5 annual reports.

Run this prompt:

Find NON-CYCLICAL EPS inflaters, quantify impact, and build a GAAP→Clean EPS view. Cite every claim (doc, page/slide).

RULES

- If not disclosed → “Unknown”. Keep currency/units.

- Use weighted-avg **diluted** shares for per-share math.

- If GAAP EPS missing: compute = NI to common ÷ diluted shares (cite both).

CHECKPOINT IDs (one row each)

A1 Disposal gains; A2 Litigation/insurance gains; A3 MTM/derivative gains.

B1 Bill-and-hold/channel stuffing; B2 Capitalized expenses; B3 Longer useful lives; B4 Reserve releases; B5 Recurring “one-time” add-backs (8Q); B6 Losses in discontinued ops; B7 IFRS FV gains (property/biological).

C1 Seasonality inflates TTM; C2 Favorable mix; C3 FX tailwind vs 3y; C4 Commodity tailwind.

D1 Low ETR vs 5y median; D2 Deferred tax remeasurement.

E1 Buybacks (shares ↓, NI flat); E2 Cheap debt/holidays/PIK; E3 Capitalized interest.

F1 WC release “sugar high”; F2 SCF/factoring optics.

G1 PPA/negative goodwill; G2 Equity-method one-offs.

CALC

EPS Impact = after-tax amount ÷ diluted shares (if pre-tax only, mark “After-tax? = No”).

% of GAAP EPS = (EPS Impact ÷ GAAP EPS) × 100.

OUTPUT — PART 1 (bullets first)

**Problem Summary (sorted by % of GAAP EPS)**

- **[ID] Name — EPS Impact: X.XX; %: YY.Y%** — short reason. Source (doc,page)

If none: **Problem Summary: None found**.

OUTPUT — PART 2 (then ONE table)

| ID | Checkpoint | Period | Problem? (Yes/No/Unknown) | Amount (ccy) | After-tax? | EPS Impact | % of GAAP EPS | 1-line reason | Evidence (short quote) | Source (doc,page/slide) |

Notes: Prefer TTM; else FY; else latest Q (label). Aggregate multiple hits within Period; provide 2–3 representative cites. Output ONLY the bullets then the table.

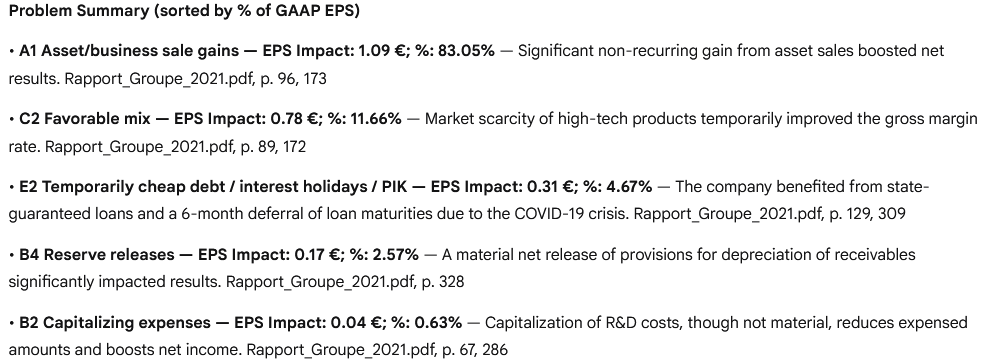

What the results look like

First, you’ll see a short summary.

Then you’ll get a master table with every checkpoint, the EPS impact, % of GAAP EPS, and direct citations.

And sometimes the difference is dramatic.

If exceptionals inflate half of earnings and P/E shows 6×, the reality is closer to 12×. That changes everything.

Which brings us to the next checkpoint: even “clean” earnings can still be at peak cycle.

Step 2: Company Cycle Check

Do the company’s own numbers look “peak-y”?

Focus on the annuals and last 8–12 quarters.

Red flags to watch for

Gross margin or EBIT margin far above the company’s 10-year median

Sudden step-ups in margin without matching capex, mix or pricing proof

Favorable segment mix vs the 3-year average

FX or commodity tailwinds vs the 3-year average

How to do it with AI

Tool: NotebookLM

Load: last 5 annual reports

Run this prompt

From filings, flag if results look above mid-cycle. First give clear bullets, then a concise table. Cite every claim (doc, page/slide). If unclear → “Unknown”. Prefer TTM; else latest FY (label).

RULES

- No “Calculated” as a source: cite the input pages used.

- Add a magnitude whenever disclosed (bps or % of GAAP EPS).

- Fallbacks: Seasonality→use quarterly GP/Rev (or H1/H2) if EPS/NI missing; Mix→use disaggregation (product/geo) if single segment; FX/Commodities→use qualitative quote if not quantified.

CHECKS (in order)

1) Margins >> history (GM%/EBIT% vs 10Y median; RED > +300 bps or > +1.5σ)

2) Step-up without proof (>+200 bps QoQ/YoY; proof = capex/mix/pricing)

3) Seasonality boosting TTM (flag if >10%; 5–10% = AMBER)

4) Favorable mix vs 3Y average (use disaggregation fallback)

5) FX/commodity tailwind vs 3Y average (material ≥100 bps margin or ≥5% EPS)

OUTPUT — PART 1 (plain-English bullets, REDs first, then AMBERs)

Red-Flag Summary

- **[Check] — Status: RED/AMBER. What it means:** ≤12 words. **Magnitude:** X bps or YY.% of GAAP EPS. **Source:** doc,page/slide

- If none: **Summary: No red flags found.**

OUTPUT — PART 2 (table only)

| Check | Status (Red/Amber/Green/Unknown) | Trigger (≤6 words) | Magnitude (bps or %EPS) | Evidence (short quote) | Sources (doc,page/slide) | Data gap (if Unknown) |

Only output the Summary bullets, then the table. No extra text.

What the results look like

A short problem summary, then a table with Seasonally Adjusted EPS, Mid-Cycle EPS (company-only), and FX/mix-neutral EPS.

This tells you if the business looks “too good” on its own numbers before checking the wider market.

Even if the company looks peak-y, you need to ask if the whole sector is also at peak. That is where sector context matters.

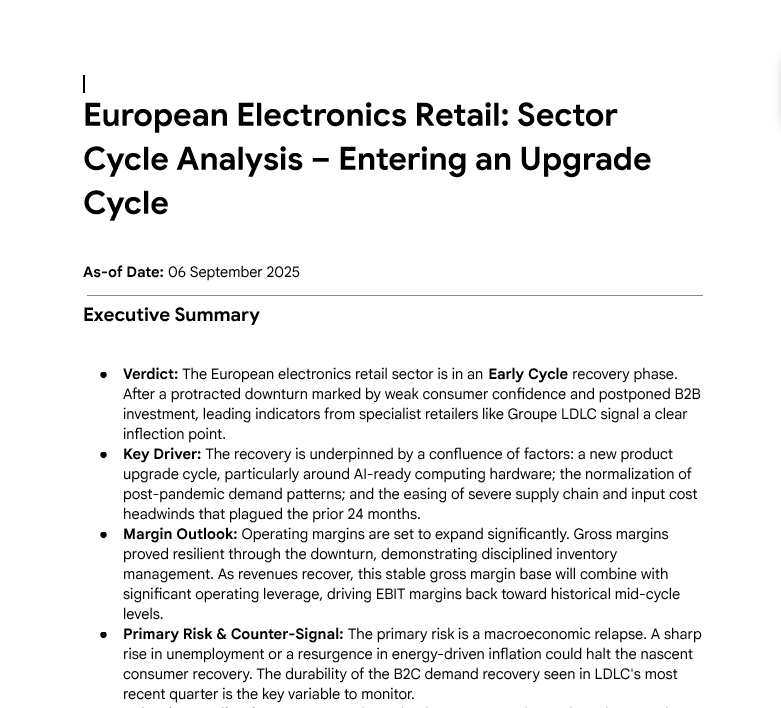

Step 3: Sector Cycle Context

At this point, you’ve stripped the accounting noise.

You’ve checked if the company’s numbers are above mid-cycle.

Now it’s time to zoom out: where are we in the industry cycle?

Red flags to watch for

Margins are far above 10-year medians

Fresh capacity adds or demand slowdowns in trade press/industry reports

Price increases rolling over in channel checks or transcripts

Input costs normalizing after a temporary windfall

How to do it with AI

Tools: DeepSearch in Gemini

NotebookLM is great for cleaning company numbers.

But here you need broader context,capacity, pricing, inputs across multiple sources. That’s where DeepSearch shines.

Run this prompt:

ROLE

You are a senior buy-side analyst and long-term investor. Produce a consulting-grade SECTOR cycle report starting from a single company name. Be precise, source-bound, and reproducible.

INPUT

Company: [COMPANY NAME]

RESOLVE UPFRONT (with citations)

- Ticker, exchange, country/region, reporting currency, fiscal year-end.

- Sector classification (NAICS/SIC/GICS) and short description.

- Fix a peer set (6–10 names): same classification, similar model, continuous listing ≥8y (fallback 5y). List tickers; LOCK this set.

- State an explicit **as-of date** in the report header.

SOURCE PRIORITY

1) Company/peer filings & transcripts; 2) Trade associations/regulators/index publishers; 3) Reputable trade press.

Each material fact: 1–2 links + ≤18-word quote. If unavailable → **Unknown** + “Data gap: [what to fetch]”.

WINDOWS

Margins: 10y (fallback 5y). Capacity/Pricing/Demand: 24–36m. Inputs/FX: vs 3y average. Use TTM for “current”; else latest FY (label).

QUALITY & NORMALIZATION

Normalize to **continuing ops** where disclosed; note restatements/policy changes. Keep units/currency; round bps/% sensibly.

SECTOR PROFILE (choose & state why)

- Commodities/CapGoods | Weights: Margins 25, Capacity/Demand 45, Pricing 20, Inputs 10

- Consumer/Retail | Weights: Margins 35, Capacity/Demand 25, Pricing 25, Inputs 15

- Software/Services | Weights: Margins 45, Capacity/Demand 15, Pricing 25, Inputs 15

TASKS (do in order)

1) MARGINS vs HISTORY & SECTOR

- Table: Company EBIT% (TTM/FY) | Company 10y median | Peer 10y medians → Sector median | Δ vs company (bps) | Δ vs sector (bps).

- FAR ABOVE = >+300 bps vs company and >+300 bps vs sector median (fallback: >+1.5σ if σ available). Note GM% if materially different.

2) CAPACITY & DEMAND (24–36m)

- Timeline (≤8 rows): [Asset/Region] | Δ capacity (units/Mt/GW/%) | Status (announced/under-construction/commissioned/idled/closed) | Commissioning/Qtr | Slip-risk (H/M/L + quote) | Direction (Tightening/Loosening).

- Demand proxies: book-to-bill, backlog level/quality, utilization, cancellations, shipments/units (numbers if disclosed). Two sources for major items. Summarize net direction.

3) PRICING TREND (12–24m)

- Realized ASP preferred; label **LIST** if list price only. Extract phrases: “discounting”, “promotional”, “givebacks”, “smaller hikes”.

- Add 1–2 relevant spot indices vs 12m avg. Verdict: Rising / Flat / Rolling over.

4) INPUTS & FX (vs 3y average)

- For each key index/FX: Current vs 3y avg (%).

Tailwind% = (3y avg − current)/3y avg; Headwind% = (current − 3y avg)/3y avg.

- If hedged: EffectiveTailwind% = Tailwind% × (1 − hedge coverage). Note tenor/coverage.

5) MIX & SEASONALITY (only if material)

- Mix: last 8Q segment Rev/EBIT mix vs 3y average; flag profit-heavy skew & durability evidence.

- Seasonality: indicate if current run-rate is above typical seasonal pattern (quarter/half-year evidence).

6) CYCLE SCORE & VERDICT (transparent)

- Start at 0; apply chosen sector **weights**:

• Margins FAR ABOVE +2; Inline 0; Below −1

• Capacity/Demand Loosening +2; Mixed +1; Tightening −1

• Pricing Rolling over +1; Flat 0; Rising −1

• Inputs Tailwind fading/Normalizing +1; Tailwind strong 0; Headwind −1

- Sum weighted score → **Cycle class**: ≥+3 Late Top; −1…+2 Mid; ≤−2 Early; strong negatives + falling margins & demand → Downturn.

- **Confidence (H/M/L)** rubric (0–6): +1 diverse source families; +1 ≥2 independent sources for capacity/pricing; +1 peer coverage ≥80% of fixed set; +1 accounting normalized; +1 hedging captured; +1 no critical data gaps.

7) THROUGH-CYCLE ANCHORS (sector → company)

- Sector mid-cycle EBIT% = sector 10y median (state range if needed).

- Company mid-cycle EBIT% anchor = company 10y median, cross-checked vs sector anchor; justify choice.

- If FX/inputs tailwind material, present **neutral** view using EffectiveTailwind%. If mix skewed, add **mix-neutral** note.

- Provide a quick **mid-cycle EPS anchor** for the company if inputs exist (TTM revenue, mid-cycle EBIT%, normalized tax via 5y median ETR, diluted shares). Else: “Unknown (Data gap: [x]).”

DISCOVERY BAND (max 3 items)

Surface up to 3 non-obvious signals that could change the verdict (lead times, channel inventory, secondary equipment prices/day-rates, hiring trends). Quote + link.

OUTPUT — EXACT SECTIONS

1) Executive Summary (≤15 bullets)

2) Method & Dataset (peer rule, windows, normalization; as-of date)

3) Margins vs History & Sector (table)

4) Capacity & Demand (timeline + net direction)

5) Pricing Trend (direction + 1–2 quotes + indices)

6) Inputs & FX (Tailwind/Headwind/Normalizing)

7) Mix & Seasonality (only if material)

8) Cycle Score & Verdict (score, class, confidence + why)

9) Through-Cycle Anchors (sector & company; EPS anchor or data gap)

10) Discovery Band (≤5 signals)

11) Evidence Table (max 12 rows)

| Factor | Indicator | Direction | Magnitude | Evidence (≤50 words) | Source (link) | As-of |

12) References ([S1]… numbered, clean links; dedupe)

CONSTRAINTS

Quotes ≤50 words; max 12 evidence rows; de-duplicate links; mark each evidence row with an **as-of date**.

If a metric is missing → **Unknown** + “Data gap: [what & where to get it]”.

The output: a 13-pag report that shows exactly where the industry stands in the cycle.

Recap

AI won’t choose stocks for you.

But it will keep you from wasting weeks on a low P/E that’s really a trap.

The workflow is simple:

Step 1: Clean the earnings :strip out exceptionals.

Step 2: Check the company’s numbers:see if margins look peak.

Step 3: Put it in sector context :know where the cycle really is.

Do this in 30 minutes, and you’ll know if 6× P/E is real value… or just noise.