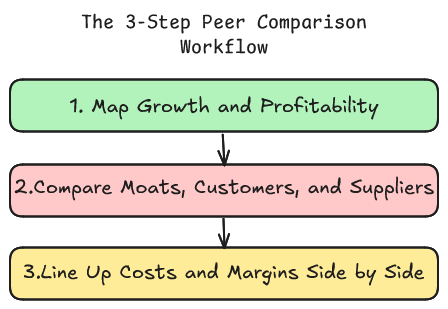

How to Spot the Industry Winner in 3 Steps

AI as Your Investing Copilot

Hello, Fellow Stock Pickers

One of my favorite habits as an investor is to revisit old analyses.

Stocks I studied, passed on, and then tracked anyway

Back in 2020, I looked at two French animal-health companies: Virbac and Vetoquinol.

Both were riding the pet-humanization trend.

I didn’t buy

5 years later both lagged the index.

But Virbac still outperformed Vetoquinol by 50%...

Same industry. Different outcomes.

That’s the lesson: same industry doesn’t mean same returns.

So how do you spot the difference early?

Usually it takes days of filings, calls, and notes.

This 3-step AI workflow compresses it into 37 minutes.

It’s not about skipping the work.

It’s about knowing which company deserves the work first.

Because time is your scarcest resource.

And this workflow makes sure you spend it where the payoff is highest.

Step 1: Map Growth and Profitability

The first move is simple: find where growth and profitability really come from.

Not at the company level but at the product and geography level.

That’s where the spread shows up:

Which company has the stronger growth profile (by product × geography)

Which one converts that growth into superior margins

Where the vulnerabilities sit if the tide turns

A simple Segment–Geography scorecard to anchor your thesis

Run the prompt once and in minutes you’ll have a clean map of growth, profitability, and risks :

Act as a comparative business analyst and generate a consulting-style dossier contrasting {Company A} and {Company B} within the {Industry}. Focus on evidence-led analysis using the 80/20 principle to highlight critical components.

Objective:

- Identify which company has a higher probability of growth over the next 5-10 years, focusing on product segments and geographies.

- Determine which company exhibits superior profitability and margin profiles linked explicitly to product segments and geographies.

Inputs:

- Peers: {Company A}, {Company B}

- Industry: {Industry}

- Currency: {Currency} (state FX basis if converted)

Source Policy:

Utilize primary/high-signal sources such as audited reports, investor decks, earnings call transcripts, regulator databases, and expert market research. Append sources to each exhibit as: [Source: Title — URL — Doc date]. Use “ND” for missing data and tag inferences with brief logic. Apply ISO date format.

Normalization:

Standardize product and region labels across companies. Align channel terms. Use reporting currency; note FX basis for conversions.

Output Format:

Markdown format with tables first, and short narrative per exhibit: Context → Insight → Implication → KPI, including direct A-vs-B comparisons throughout.

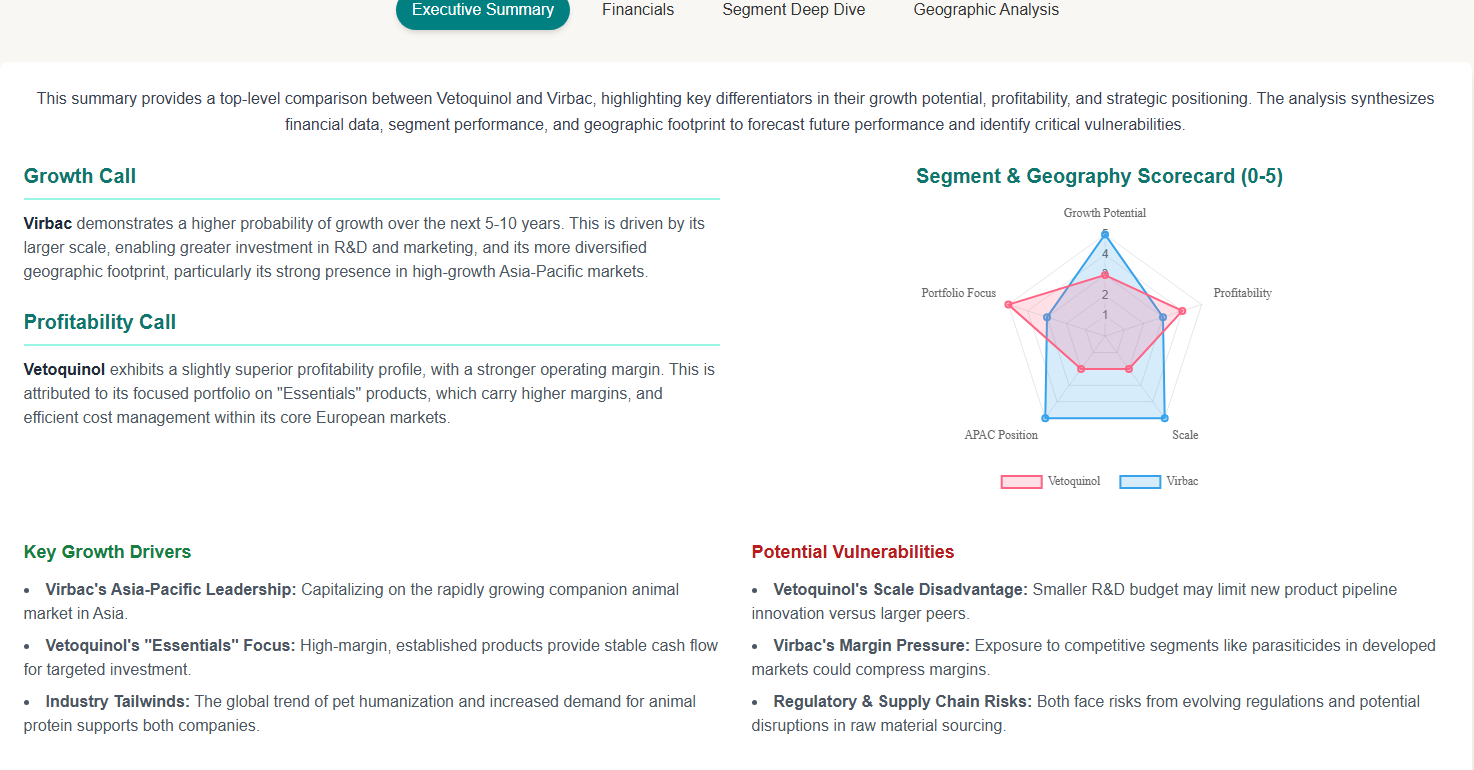

1. Executive Summary

- Growth call: Declare which business has a greater growth probability based on product × geography, including 2–3 factual reasons.

- Profitability call: State which business has better margin/earnings quality, tied to specific segments and geographies.

- Identify 3 growth drivers explaining future growth odds.

- Highlight 3 vulnerabilities that might flip growth margins.

- Provide a Segment–Geography scorecard (0–5).

- Outline 3 business KPIs for the next 12–24 months.

2. SECTION A — Top Cells: Analyze top products by country.

3. SECTION B — Price Control & Route-to-Market: Assess net price realization efficiency.

4. SECTION C — Supply Resilience: Evaluate supply sourcing and continuity.

5. SECTION D — Segment Growth Engines: Examine growth drivers and profitability.

6. SECTION E — Product & Geography Overview: Contextualize product and geographical analysis.

7. SECTION F — Competitive Landscape: Scrutinize competitive positioning.

8. SECTION G — Risks by Segment: Map potential risks.

9. SECTION H — Causal Diagnosis & Decision: Compare causal disparities and suggest KPI-driven actions.

Quality Checks:

- Ensure explicit A vs B contrasts.

- Normalize labels and currencies.

- End each exhibit with Context → Insight → Implication → KPI, and a source tag.

- Apply the 80/20 filter to prioritize impactful segments.This step is the foundation.

With Virbac vs Vetoquinol, the report made the contrast obvious.

Step 2: Compare Moats, Customers, and Suppliers

Once you know what drives growth and profitability , the next question is simple:

Who has the real bargaining power with customers, with suppliers, with the market

It forces you to compare peers on 3 levers that decide long-term outcomes:

Moats : what the competitor can’t copy

Customer relationships : who sets the terms on price and access

Supplier links : what’s the nature of each relationship?

This is where advantage becomes visible.

Margins, growth, and resilience all tie back to these levers.

Copy the prompt. Run it in Gemini.

In minutes, you’ll know these businesses like you’ve followed them for 5 years