I Built My Own Stock Analyst with AI

Stop Starting From 0 Every Quarter

Here’s how to follow a stock over time without losing track of what matters :

Understand the business once.

Use AI to keep the coverage up to date.

One stock.

One place.

Every quarter.

No scattered notes.

No context loss.

Here’s the system.

Create one permanent home for the stock (NotebookLM).

A single place where everything about the business lives.Teach the system how the business work (with the right prompts)

So new information is always interpreted in context.Create a clear starting point (thesis + anti-thesis).

A fast way to remember the theses and what could break it.Update the same system every quarter.

Compare promises vs reality. Track what actually changed.Let the knowledge compound over time.

No restarting. No context loss. Just better judgment.

Now let’s walk through each step, using Booking Holdings as an example:

Step 1 : Create the permanent home

Before doing any analysis, you need one thing:

a place to store and update your knowledge over time.

You’ll be summarizing documents.

Comparing them.

Coming back to them every quarter.

So everything must live in one place.

I use NotebookLM because it does 3 things most tools don’t:

It keeps context intact over time

It handles hundreds of pages at once

It answers only from your documents (no hallucinations)

It’s built for exactly this job:

long-term coverage, not one-off answers.

Now create the home.

Open NotebookLM.

Create a new notebook.

Name it: [Ticker] Analyst

This notebook is the only place you’ll ever use for this stock.

From now on, every report, note, and update will live in this one place.

Step 2 : Teach the analyst the industry fundamentals

Think of this step as onboarding a new analyst.

Before analyzing the company, he needs to understand the industry it operates in.

Company results only make sense when you know:

why the industry exists

how value is created and captured

what structurally limits growth

With 1 prompt, I generate an industry overview once and keep it forever.

Here’s the exact prompt I use.

ROLE

You are an industry analyst writing for long-term equity investors.

Industry to analyze: [Insert Industry Name]

PURPOSE

Produce a concise, factual industry overview that explains how the industry works, where growth comes from, and what structurally limits it — without speculation or narrative fluff.

The goal is to understand:

Why this industry exists

How value is created and captured

What realistically drives or constrains growth over time

EVIDENCE & DISCIPLINE

Base the analysis on:

Reputable independent industry reports

Official company filings of major industry players (annual reports, MD&A)

Regulator or industry body publications

If a point is not clearly supported, mark it as (inferred) or (unknown).

Avoid forecasts without mechanisms. No opinions, no hype.

OUTPUT STRUCTURE (6 SECTIONS ONLY)

Target length: 1,200–1,800 words

1. Industry Purpose & Core Economics

What fundamental customer problem does the industry solve?

What is being sold (products/services) and why customers pay for it

Where economic value is created along the value chain

Typical margin profile and capital intensity

Is the industry structurally simple, complex, cyclical, or regulated?

2. Industry Structure & Competitive Shape

Market structure: fragmented, consolidated, oligopolistic, regulated

Profit pool concentration (who captures most of the value, and why)

Barriers to entry (capital, regulation, switching costs, scale, IP)

Typical sources of competitive advantage at the industry level

3. Demand & Growth Drivers

Focus on mechanisms, not slogans:

Demand-side drivers (demographics, usage intensity, regulation, substitution)

Pricing power vs volume growth

Geographic or segment expansion logic

What must go right for growth to materialize

4. Supply Side, Cost Structure & Constraints

Key inputs and suppliers

Cost drivers and margin sensitivities

Capacity, capex cycles, or scaling limits

Structural constraints (regulation, resources, labor, technology)

5. Technology, Regulation & Structural Change

Technologies that materially change costs, productivity, or pricing power

Regulatory forces that expand or cap industry economics

Business model shifts observable today (not hypothetical)

Which changes strengthen incumbents vs enable disruption

6. Medium-Term Outlook (5–10 Years, Non-Speculative)

Frame scenarios, not predictions:

Base case: continuation of current economic logic

Upside case: what structural lever improves economics

Downside case: what breaks (pricing, regulation, capital cycle)

Key indicators investors should monitor

END WITH: Investor Synthesis (5 BULLETS)

Core economic engine of the industry

Primary growth lever

Structural constraint investors underestimate

Key risk that could change the industry’s trajectory

What kind of companies tend to win in this industryRun this prompt in Deep Research mode to get a source-backed, structured industry overview instead of a generic answer.

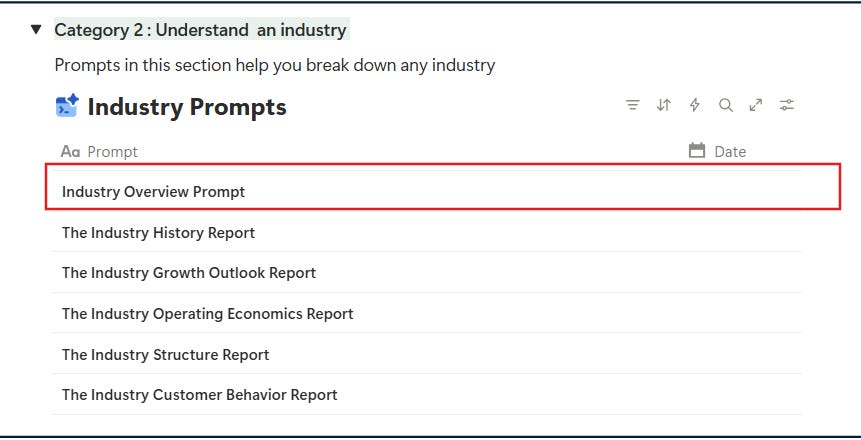

Note: I’ve added this prompt to the Prompt Library, so you can copy-paste it anytime and use it as your default starting point when analyzing a new industry.

The results is a high quality report like this one :