Is Your Portfolio Ready for 2026?

Don’t Enter 2026 Without Running These 3 Prompts

You’ve probably heard it already.

2026 will be the year of AI…

Or the year of the big crash…

Or the year rates finally break something.

Maybe all of it. Maybe none of it.

I don’t try to guess which one is right.

As a long-term investor, I care about one thing:

What can break my portfolio ?

So once a year, I step back and run a simple check.

Here’s how I use AI to stress-test my portfolio for 2026:

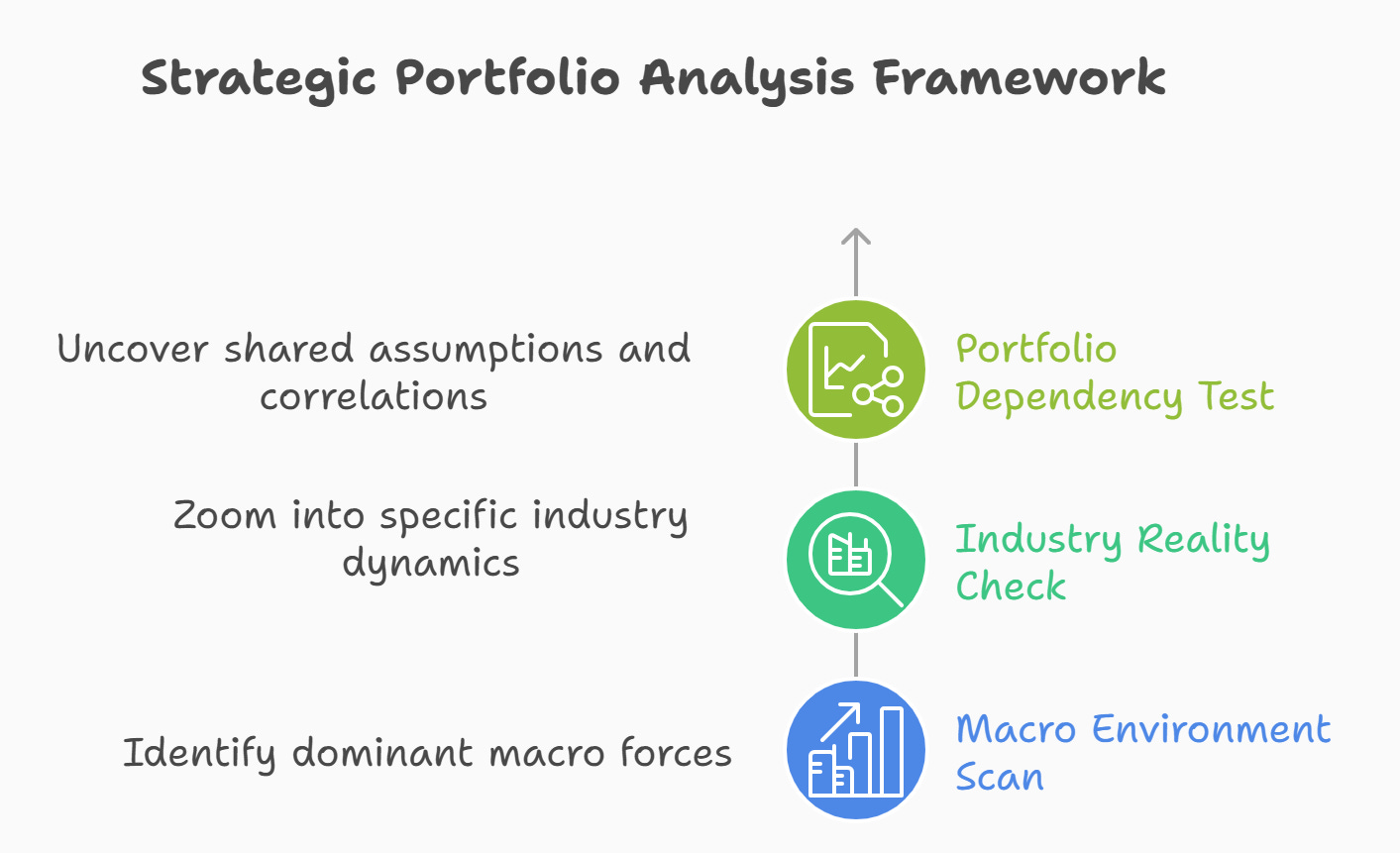

The Annual Reality Check:

1. The Environment Scan

Macro conditions shaping how businesses operate, globally or in a specific geography.

2. The Industry Reality Check

Which trends from 2025 are continuing and why.

Customer behavior, regulation, technology, and competition within a specific industry.

3. The Portfolio Dependency Test

Is my portfolio ready.

Hidden correlations, shared assumptions, and false diversification that appear under stress.

Step 1: The Environment Scan

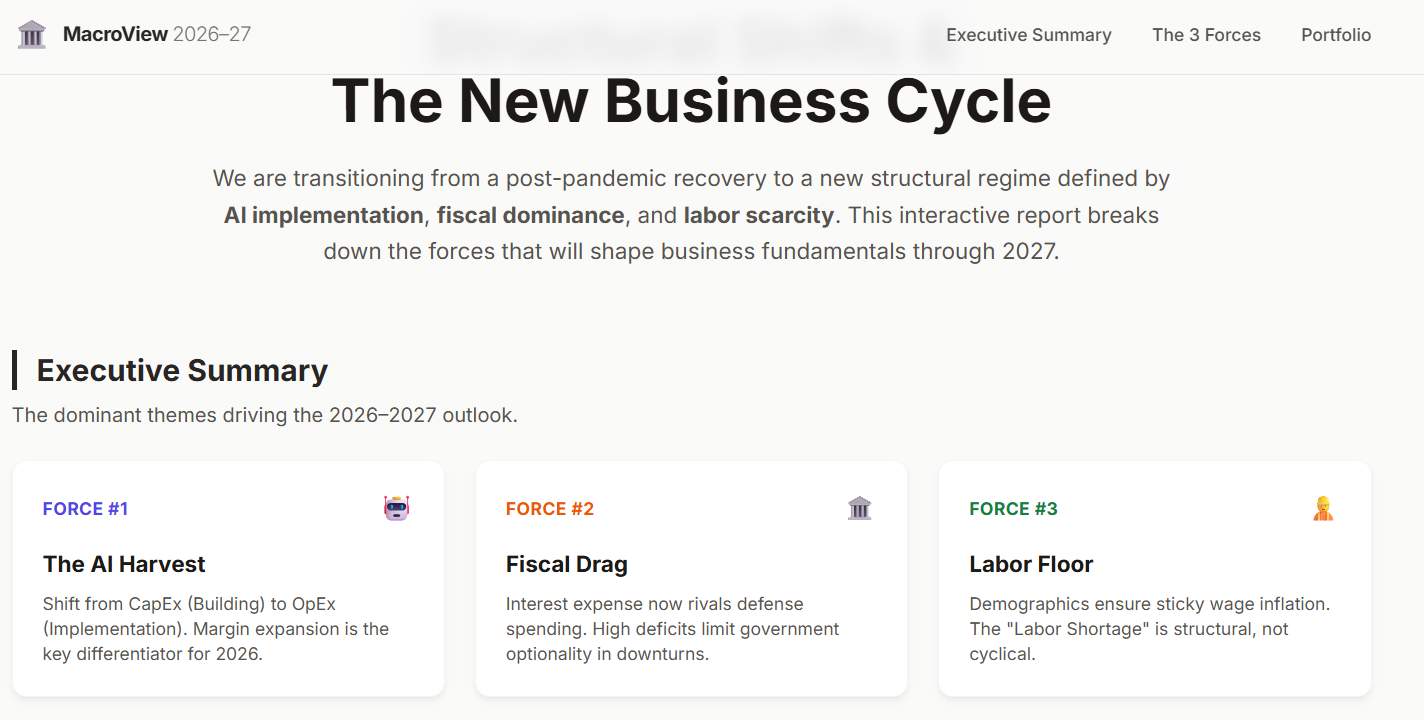

Before you stress-test anything, you need to know the environment we are living in.

what forces are already in motion and which ones will still be here in 12–24 months?

This is the foundation.

If you don’t understand the macro context, you can’t judge:

Which sectors are swimming against the current

Which business models are fragile right now

What your portfolio is implicitly betting on

This prompt gives you a clear picture of the world heading into 2026–2027.

Pick your region (US / Europe / Global…)

Open Gemini (Deep Research) or any LLM with deep research mode.

Paste the prompt.

You’ll get a 10–20 page report.

CONTEXT

I am a long-term equity investor.

This is NOT about predicting markets or prices.

The objective is to identify macro forces most likely to persist into 2026–2027 that could materially impact business fundamentals.

Today's date: December 2025.

ROLE

You are a macro strategist.

REGION

[INSERT: Global / US / Europe / Asia / Emerging Markets]

SOURCES TO USE

Published views from macro experts with verified track records, including:

- Macro investors: Dalio, Druckenmiller, Marks, Klarman, Grantham, Einhorn, Burry, Tepper, Bass, Zell

- Economists: El-Erian, Summers, Roubini, Rogoff, Blanchard

- Central banks: Fed, ECB, BoJ, BoE communications

- Institutions: IMF, BIS, World Bank

- Research houses: Bridgewater, GMO, Variant Perception, TS Lombard, Gavekal, BCA Research

Avoid: anonymous commentary, headlines without source, social media speculation.

RULES

- Focus on forces already in motion — not tail risks

- Every claim must have evidence or be marked (inferred)

- Avoid vague words: "uncertainty", "volatility", "headwinds"

- Do NOT predict prices or name stocks

TASK

Identify the macro forces most likely to shape business fundamentals in 2026–2027.

For each force:

- Is it structural (multi-year) or cyclical (temporary)?

- Was it present in 2025? Will it continue, fade, or accelerate?

Rank by impact — focus on the 3-4 forces that matter most.

OUTPUT

EXECUTIVE SUMMARY

In 5–7 bullets:

- What are the 2–3 dominant macro forces for 2026–2027?

- Which 2025 trends will persist? Which will fade?

- What must go right for equities to perform?

- What risk is underpriced?

- What signals to watch in H1 2026?

MACRO FORCES (RANKED BY IMPACT)

For each force:

**Force [#]: [Name]**

1. What is it?

2–3 sentences. Concrete.

2. Structural or cyclical?

Why?

3. 2025 → 2026 trajectory

Continue / accelerate / fade? What changed?

4. Probability & duration

Low / Medium / High

6 months / 1–2 years / 3+ years

5. Impact on businesses

How does this force affect:

- Revenue

- Margins

- Cash flow

- Balance sheets

6. Who benefits / who suffers

Business models only — no stock names.

7. Confirmation signal

"If [X] happens, this force is playing out."

8. Invalidation signal

"If [Y] happens, this force is likely wrong."

9. Source

Who said this? When?

SUMMARY TABLE

| Rank | Force | Structural/Cyclical | 2025→2026 | Probability | Business Impact | Key Signal |

QUALITY CHECK

- No price predictions

- No stock names

- No vague language

- Every force linked to business fundamentals

- Sources attributedWhat you get:

A clear view of the 3–5 forces that actually matter over the next 12–24 months.

This isn’t about calling markets or making trades.

It’s about stepping back and asking better questions about your portfolio.

We do this once a year on purpose.

After that, macro is just a way to sound smart at family dinners.

Step 2: Industry Reality Check

Now that you know the macro forces in motion, it’s time to zoom in.

This is where you stop guessing and look at what actually changed inside the industries you own.

What shifted in 2025.

What’s still playing out.

What’s already fading.

What this prompt does:

It scans your industry across 6 core dimensions:

Macro impact : how rates, growth, and credit hit this industry

Customer behavior : what they buy, how they buy, what they’ll pay for

Technology shifts : what’s automating, disrupting, or enabling new models

Regulation : what changed in 2025, what’s emerging in 2026

Competition : who’s consolidating, who’s exiting, where pricing power sits

Business models : which survive stress, which break

Pick one industry you own (semiconductors, SaaS, luxury, payments, etc.)

Open Gemini Deep Research

Paste the prompt below