The 20-Minute AI Workflow to Understand Complex Businesses

A simple challenge turned into a repeatable playbook

Hello, Fellow Stock Pickers

Yesterday Heavy Moat Investments asked on Substack: “Any great primer on the stock-exchange industry?”

I didn’t know the industry, so I gave myself a challenge: learn it quickly, make something useful, and show the exact steps I used with AI.

The usual way takes a whole weekend.

With AI, I cut it to 20 minutes…

I ran the process on the stock exchange sector. Here’s the playbook you can copy:

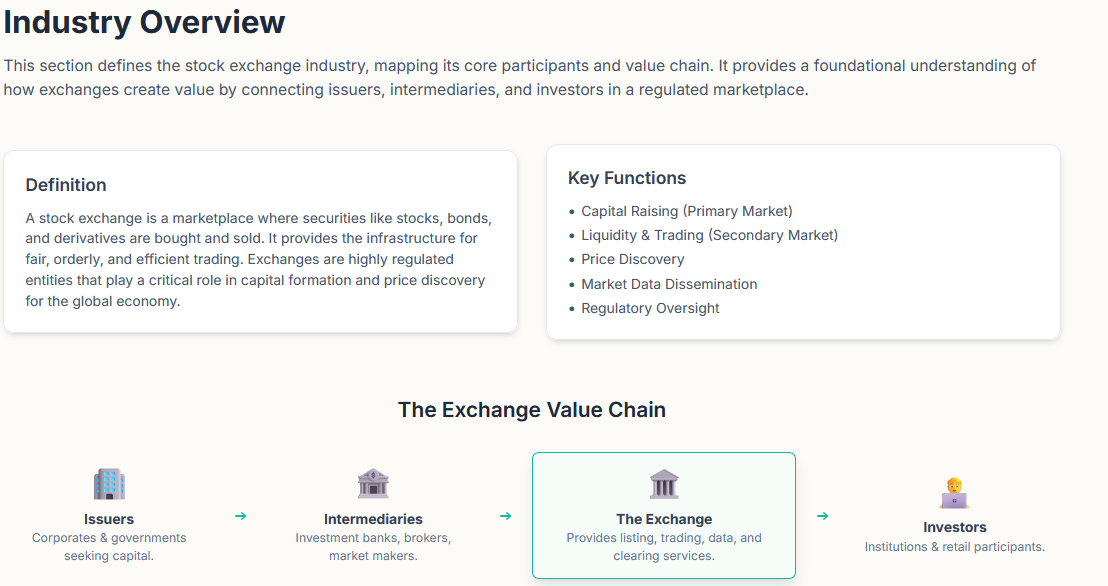

Step 1: Learn How the Industry Works

First thing I always do is to get an idea of the industry before I look at a single company.

Here’s where AI makes life easier.

A DeepSearch function in an LLM (I prefer Gemini) is great for pulling reports, summarizing, and explaining the basics.

Yes, sometimes it may get some numbers wrong… but at this stage that doesn’t matter. The point is to build context fast.

What I ask for :

I explain what I want to understand.

I set boundaries on where to search (filings, regulators…)

I tell the model the exact format I want the output in.

Here’s the exact prompt I use:

ROLE

Senior equity analyst. Produce a €10k-grade sector dossier. No speculation. Zero hallucinations. All facts verifiable via high-quality sources.

INPUT

{SECTOR_NAME} for example stock exchange industry

OBJECTIVE

Go from zero to expert on {SECTOR_NAME}: revenue model, growth drivers, cost/margins, constraints, regulation, comps, risks. Deliver a 1-page executive summary + full report with charts and compact data tables.

SOURCE POLICY (STRICT)

Priority A→E:

A) Primary filings & IR (10-K/20-F/URD/S-1, audited IFRS/GAAP, investor days, official transcripts via EDGAR/ESMA/SEDAR+/etc.)

B) Regulators/statistics/multilaterals (SEC, ESMA, OECD, IMF, BIS, IEA/IRENA, ITU, national stats offices)

C) Trade associations with transparent methods

D) Tier-one journals/consultancies disclosing primary data

E) Official exchanges/data vendors (WFE, ICE, LME, S&P Global, Refinitiv) with methodology

Disallowed: SEO blogs, AI-generated pages, anonymous posts, vendor marketing without data, unsourced market sizes, Wikipedia for facts.

RETRIEVAL GUARDS

- Recency bias ≤24 months; older “Legacy” items only if seminal.

- Prefer {REGION}; else Global with regional splits.

- De-dupe. Use latest amended versions.

- If evidence missing: write “Insufficient high-quality evidence” + TODO.

NUMERIC FACT-CHECK PROTOCOL (MANDATORY)

Before outputting any number:

1) Record value, unit, period.

2) Verify against ≥2 independent A–D sources. If not possible, label “Single-source (Low confidence)”.

3) Run sanity checks: order-of-magnitude vs peers/sector; unit conversions correct; time period consistent.

4) If conflict >5%, state both figures, sources, and reason for variance.

5) If uncertain: do not estimate. Mark “Unknown”.

DEFINITION FIRST

- Define {SECTOR_NAME}, subsegments, value chain, buyer types.

- Map to NAICS/NACE/ICB/GICS; list synonyms and boundary cases.

- If ambiguous, present options, select consensus definition, justify briefly.

SEARCH PLAN (EXECUTE)

- Boolean queries with synonyms, codes, “site:” filters for A–E.

- Pull filings of top players; regulator rulebooks; trade-body yearbooks.

SOURCE LIST (COMPACT)

- Cap at 10–15 core sources.

- Present as a simple table (Title | Org | Type A–E | Date | Region | Link | Confidence High/Med/Low).

- No JSON. No page-by-page dump.

ANALYTICAL FRAMEWORK

5.1 Revenue model

- Who pays, why; pricing archetypes; sales motion; contract terms; switching costs; seasonality.

- Unit economics: ARPU/volume/utilization/churn; key sensitivities.

5.2 Growth drivers

- Structural vs cyclical; adoption curves; penetration vs TAM/SAM/SOM with defendable numbers.

- 5–10y scenarios with explicit assumptions and a simple tornado/sensitivity.

5.3 Cost structure & margins

- COGS vs Opex (labor, inputs, infra, compliance).

- Margin stack: Gross→EBITDA→EBIT→FCF; operating-leverage drivers; historical shifts.

5.4 Constraints to scale/margin expansion

- Technical bottlenecks, capex intensity, WC needs, supply chain, distribution, CAC, standards/interoperability, talent.

5.5 Regulation & exogenous factors

- Licenses; data/privacy/safety; environmental rules; trade/tariffs; upcoming proposals and likely timing/impact.

5.6 Benchmarks (peers)

- Table of 5–10 companies: model archetype, geography, revenue mix, margin range, capex %, FCF conversion, ROCE/ROIC, leverage.

- Cite latest audited period.

5.7 Risk register

- 8–12 risks with likelihood/impact, leading indicators, mitigants.

VISUALS

- Include clean CSV-ready tables used for each figure.

- Required figures: value chain map; revenue model schematic; cost stack + margin bridge; market size/penetration over time; scenario tornado.

- No code blocks unless asked. Keep charts reproducible from provided tables.

OUTPUT FORMAT

Page 1 — Executive Summary (≤300 words):

- What the sector sells, who pays, why now

- 3–5 growth drivers

- Margin outlook

- 3 key risks

- List of figures

Main Report:

- Sections 5.1–5.7. Use minimal in-text footnotes like [1], [2] linking to the Source List.

Appendices:

- A) Source List table (10–15 items, links only)

- B) Glossary

- C) Assumptions & Methods

- D) Data tables (CSV-ready)

QUALITY BAR

- Zero unsupported claims. Prefer “Unknown” over guessing.

- Show data vintage and units; convert to {CURRENCY} if provided; add FX note/date.

- Tag each section with Confidence High/Med/Low + one-line rationale.

- End with “Next Research Steps” to close evidence gaps.

BEGIN

1) Sector definition, subsegments, code mappings with 2–3 top sources.

2) Source List table (max 15).

3) Executive Summary, then full report using the fact-check protocol. The result is usually a 20+ page detailed report.

Don’t read it all now. Just keep it.

What matters at this stage is the one-page executive summary.

The big report will become useful later when we tie everything together in Step 4.

Step 2: See Who the Real Players Are

After you understand how the industry works, the next step is : who are the main players, and how do they compete?

This is where investors often get lost.

They know the names :LSEG, Deutsche Börse, Euronext, ICE, Nasdaq…

In reality, exchanges don’t compete “in general.” They compete in lanes.

Some dominate cash trading (auctions, lit markets).

Others make most of their money in clearing.

Others are really data and index businesses disguised as exchanges.

If you don’t separate them and compare , you’ll miss why margins, growth, and moats look so different from one operator to another.

That’s why in this step I use a prompt to:

Map the players by lane (cash, derivatives, data/IP, clearing, etc.).

Explain why customers choose them (liquidity, fees, speed, brand, regulation).

Highlight differentiation and moats (network effects, index tie-ins, CCP benefits).

Show switching costs (why issuers, brokers, and asset managers don’t easily move).

Here’s the prompt I use: