The 3-Step Playbook for Learning a New Sector Fast

Inspired by my 5× tanker trade

Hello, Fellow Stock Pickers

4 years ago, I spent a month buried in shipping reports.

Freight rates, shipbroker notes, obscure terms like VLCCs and scrapping cycles.

That deep dive turned into a 5× return on tanker stocks.

It was a bet on a sector driven by cycles.

this isn’t my main investing strategy.

But when it works, it works big.

But for a generalist investor, the barrier to entry is high.

you need to understand a lot before you even start deeper analysis.

Back then, it took me a full month just to get the sector straight in my head.

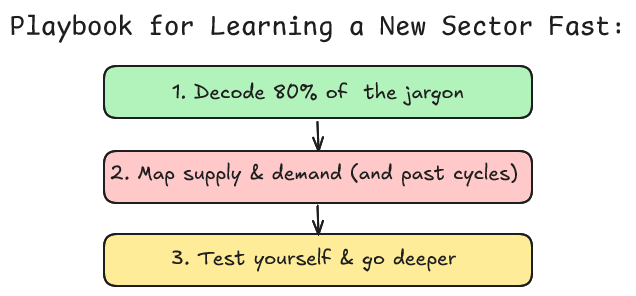

I reviewed my notes and turned them into a playbook. A shortcut you can use anytime you tackle a new sector using AI. :

1) Decode the jargon (so you can think clearly)

In any sector, the first barrier is the language.

Good news: 20% of terms explain 80% of what you’ll read.

How to do it (fast) with AI:

Use ChatGPT (Thinking mode) for this step, it’s great at this.

Ask it to:

List 20–25 must-know terms for the sector.

Explain each in plain English (1–2 short lines).

Tie each term to revenue/margins (why it matters).

Give one simple example (numbers if helpful).

Tell you what to watch next (KPI or data source).

Cite a source or write “Data gap: …” instead of guessing.

Or just steal my ready to use prompt :