The Secret Behind 10× Faster Stock Research

Why DeepSearch Is the Answer ?

The second most common question I get is :

“Why do you use DeepSearch for your investing reaserch”?

My answer:

It works better than anything else for understanding a business .

Today, I will explain why :

(And before you ask , the #1 question is how I write 2-page detailed prompts. That’s a story for another day.)

The True Power of AI in Investing

Going from “What’s this stock?” to “I get how this business actually works” is the biggest leverage AI gives an investor.

AI helps us grasp a company’s model quickly, but only if we ask well.

When I find a new stock, I want quick answers to:

What they sell and who buys : product, customer, and reason for purchase.

How they make money :revenue model, pricing logic, monetization path.

Revenue quality :recurring vs one-off, stability, and concentration.

Cost structure : margins, scalability, key cost drivers.

Capital intensity : assets, working capital, reinvestment needs.

Growth drivers : price, volume, geography, mega trends.

Competitive edge : what defends profits over time.

To get those answers, I could read the annual report.

It’s solid and reliable but not what I need at this stage.

I’d spend hours flipping pages just to confirm the basics…

That first scan should take minutes, not half a day.

If the numbers look right, then I’ll go deeper.

3 ways I can go faster:

Google it : slow ..realy slow…

Ask a standard LLM : decent, but surface-level.

Run DeepSearch in Gemini: delivers a sourced, structured report in 15 minutes.

DeepSearch vs standard ChatGPT: Same Prompt, Completely Different Outcome

DeepSearch is a research mode built intoLLM’s , ChatGPT, Gemini, and Perplexity

let’s compare standard ChatGPT vs DeepSearch using the same prompt (shared at the end of this newsletter).

I was working on a French AI-related stock AL2SI.PA ( yes, that exists in Europe also ) and tested both.

Standard ChatGPT without DeepSearch:

Results were fine. It “thought” for 90 seconds, checked a few sources, and produced a generic description , better than Google, but nothing special.

DeepSearch:

With the same prompt, DeepSearch came back with a 15-page report that was clear and well structured.

I could read it in minutes and feel like I’d spent hours studying the company

And the best part is, I can condense the entire 15-page report into a clean one-pager with a single click.

Do I need I continue the comparison?

Probably not.

But let’s unpack why the difference is that big.

1. DeepSearch asks better questions

every analysis starts with a question:

“Analyz the business model, segments, margins, and growth drivers.”

Standard ChatGPT or Gemini treats this literally , it answers what’s written and doesn’t expand the scope.

DeepSearch works differently. It maps the hidden structure behind your query. It recognizes connected themes like:

revenue mix

EUV capacity

service margins

capex plan

guidance

Behind the scenes, DeepSearch does much more than a simple query:

Breaks down your prompt word by word to understand its structure.

Finds synonyms and related concepts to widen the search scope.

Retrieves documents (filings, transcripts, investor decks) that mention those ideas.

Reads and filters the relevant paragraphs often pulling from over 100 sources.

Synthesizes the evidence into a single, coherent answer.

It doesn’t just react to words. It understands intent.

2. DeepSearch digs into real sources

Instead of relying mainly on pre-trained memory, DeepSearch looks up real source material like annual reports, investor decks, transcripts, regulatory filings.

It extracts the relevant sections line by line and brings them into context.

So when you ask “What drives margins drivers?”, it doesn’t guess it pulls sentences directly from the CFO explaining it.

That’s the difference:

ChatGPT remembers.

DeepSearch reads.

3.DeepSearch builds evidence you can trust

The result is not a prettier paragraph.

It’s a completely different kind of output:

Every claim is sourced.

Every number links back to a page.

Every paragraph is built from evidence, not memory.

The final comparison

I summarized the differences in my own words, without getting technical.

But honestly, the results above speak for themselves.

Why drive a Toyota when you can have a Ferrari for same price?

Why I Use Gemini

DeepSearch exist in all LLM’S but I prefre Gemini for 3 reasons:

Access: ChatGPT limits DeepSearch queries per month, even for paid users. Gemini doesn’t.

Integration: Gemini lets you instantly turn a DeepSearch report into a one-page website, a quiz, or even a podcast version.

Trial: You get a 1 month free trial , worth testing.

And honestly, the results just feel better than ChatGPT or Perplexity , no hard proof, just my experience.

The Takeaway

Imagine You hire 2 interns and you ask: “Tell me how this business actually makes money.”

Intern A (standard ChatGPT)

He’s fast. Smart. Confident.

10 minutes later, you get a clean summary of business model, margins, growth drivers.

It sounds good… until you ask, “Where did this come from?”

He hesitates.

“Oh, I remember reading something like that once.”

He can’t open reports or verify numbers.

He works mainly from memory.

Intern B (DeepSearch)

Same brain. Different habits.

Before writing, she opens filings, reads the CEO’s letter, checks transcripts, compares last quarter’s data.

An hour later, she’s back.

Every claim sourced.

Every number traced.

Every quote verified.

You ask, “So margins fell because of mix shift?”

She points to the CFO’s exact line.

The Difference

One intern remembers.

The other understands.

That’s why DeepSearch wins.

This Week’s Investing Prompt:

In every newsletter, I share at least one ready-to-use prompt, something I’ve tested and actually use myself.

Today’s prompt is the one I start with when I want a quick overview of a new business.

(And by now, you can probably guess where I run it: inside DeepSearch in Gemini.)

You are a professional equity analyst writing a high-quality company brief for long-term investors.

Analyze 2CRSi using the 7-point framework below.

Use only verifiable, factual information (annual reports, investor presentations, filings, earnings transcripts, and reputable financial sources).

Be concise, analytical, and concrete — no filler or marketing language.

Output format (exact structure required):

Executive Summary (≈150–200 words)

Summarize in plain English how this company makes money, its economic quality, and where its edge and risks lie.

End with one sentence stating how you’d describe the business to an investor in one line.

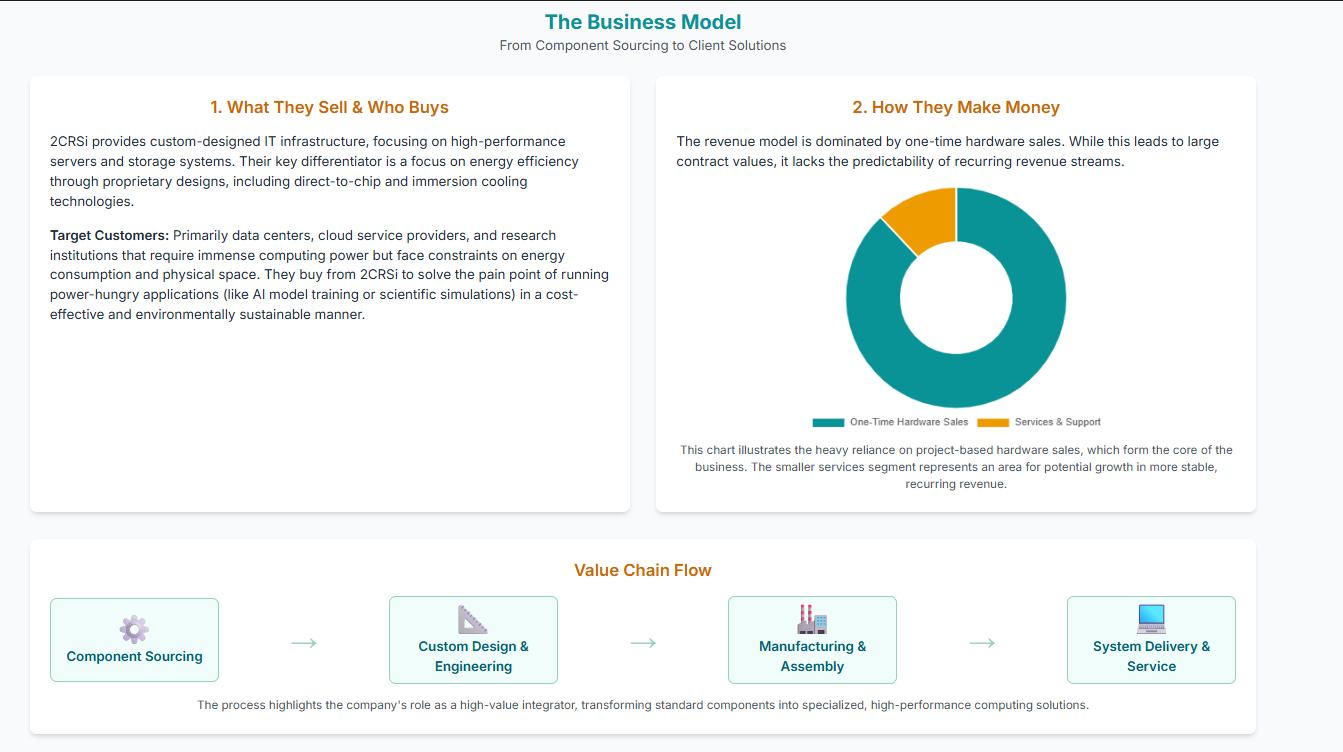

1. What They Sell and Who Buys

Describe the main products or services.

Define target customers (type, segment, geography) and why they buy — main pain point or motivation.

2. How They Make Money

Explain the revenue model and pricing logic.

Clarify whether it’s one-time, recurring, transaction-based, or hybrid.

Include key revenue segments and their share if available.

3. Revenue Quality

Assess how predictable and diversified revenues are.

Break down recurring vs one-off components, customer or segment concentration, and exposure to cycles.

4. Cost Structure

Outline major cost drivers (COGS, labor, logistics, marketing, etc.).

Include gross and operating margins where possible.

Comment on scalability — fixed vs variable costs and how margins move with growth.

5. Capital Intensity

Describe assets needed to run and grow operations.

Include capital expenditures, working-capital needs, and cash conversion efficiency.

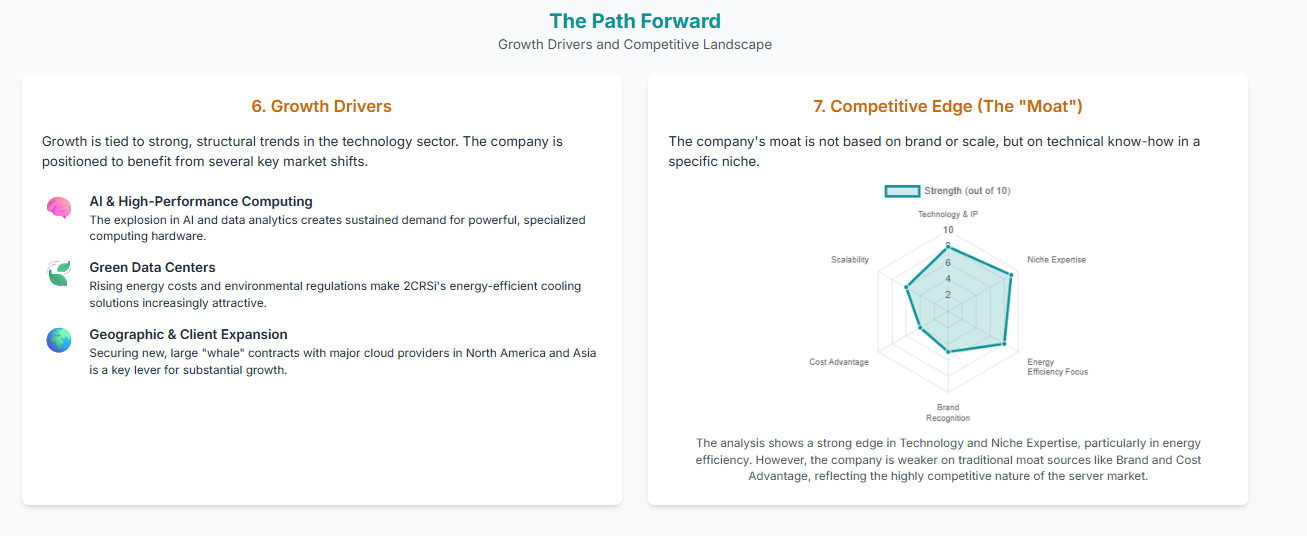

6. Growth Drivers

Identify the main levers for revenue growth — volume, pricing, product mix, geographic expansion, or acquisitions.

Clarify if these are structural (long-term) or cyclical (short-term).

7. Competitive Edge

Explain what protects the company’s economics from competition: brand, cost advantage, switching cost, regulation, network effects, data, or IP.

Mention how durable and testable this moat appears based on financial evidence (margins, ROIC, retention).

Tone: Analytical, neutral, precise.

Goal: Produce a concise yet rich narrative that lets an investor understand how this business actually works.PS: If you enjoyed this newsletter, share it with another investor who wants to use AI to move faster.

Thank you very much!

Actually, I tried again to ask GIMINI this time to create a report like yours, it told me that it cannot create a PDF file.

Can you explain how you do it? It looks great!

I have a tactical question for you:

I got a new Samsung S25+ back in July. It came with a 6-month free pro subscription to Google AI. It appears that not only do I have a pro subscription to Gemini, but also Notebook LM which I discovered here on your Substack. My 6 months will be up in December, and I will have a choice to make: pay $20 a month to keep my current set-up or let it expire and go back to using Chat GPT. My fear is that choosing Chat GPT would require me to purchase a second subscription pro to keep using Notebook LM.

My question is which is better in your opinion, Chat GPT or Gemini? I have only used the free version of Chat GPT before receiving my 6-month free trial of Google AI Pro, so I am comparing free Chat GPT to Gemini Pro based on my personal use. I notice many investors use Chat GPT. I don´t know if this is due to Chat GPT being the first to market, or if it is a superior product.

Any thoughts? I feel your opinion would be much more informed than what I have been receiving from others (and Gemini itself). The $20 a month is not an issue, but rather which path to take - Google AI Pro or Chat GPT. Thanks!