Turn Billionaire Investors Into Your Unpaid Analysts

A simple AI workflow to copy elite investors

You can now hire François Rochon, Terry Smith, or any of your favorite investors as your unpaid analysts.

Imagine this:

You’re looking at a new stock.

Normally, you’d start digging through filings, presentations, transcripts…

But now you just think,

Would François Rochon say “wonderful business”… or “next, please?”

The man compounded at 15% for 30 years so he probably has a useful opinion.

Here’s the workflow that makes this real.

Step 1 : Evaluate the Business Model (Rochon-Style)

Rochon always starts in the same place when he studies a company.

Is this even a high-quality business?

He evaluates a business using a few essential filters:

Is the model simple enough to explain in one breath?

Does the company lead its market?

Does it have real pricing power?

Are customers locked in (switching costs)?

Does it benefit from scale or network effects?

Is the business resilient through cycles?

Can the moat survive for 10–15 years?

If the answers are weak, he moves on.

And now you can run this exact framework with AI.

Here’s how to do it in DeepResearch with Gemini :

1. Copy the prompt below and change the stock name.

Analyze the following company:

booking

Evaluate its BUSINESS MODEL QUALITY using François Rochon’s qualitative framework.

Do not analyze financial strength, management or valuation they belong to other pillars.

ROLE

You are applying François Rochon’s Business Model Quality framework.

Use evidence from filings, transcripts, investor presentations, industry reports, expert commentary and reliable secondary sources.

If you infer something based on industry logic, mark it as “industry inference”.

Do not fabricate numeric market-shares or financials.

STRUCTURE OF OUTPUT

Produce the report in two sections, in exactly this order:

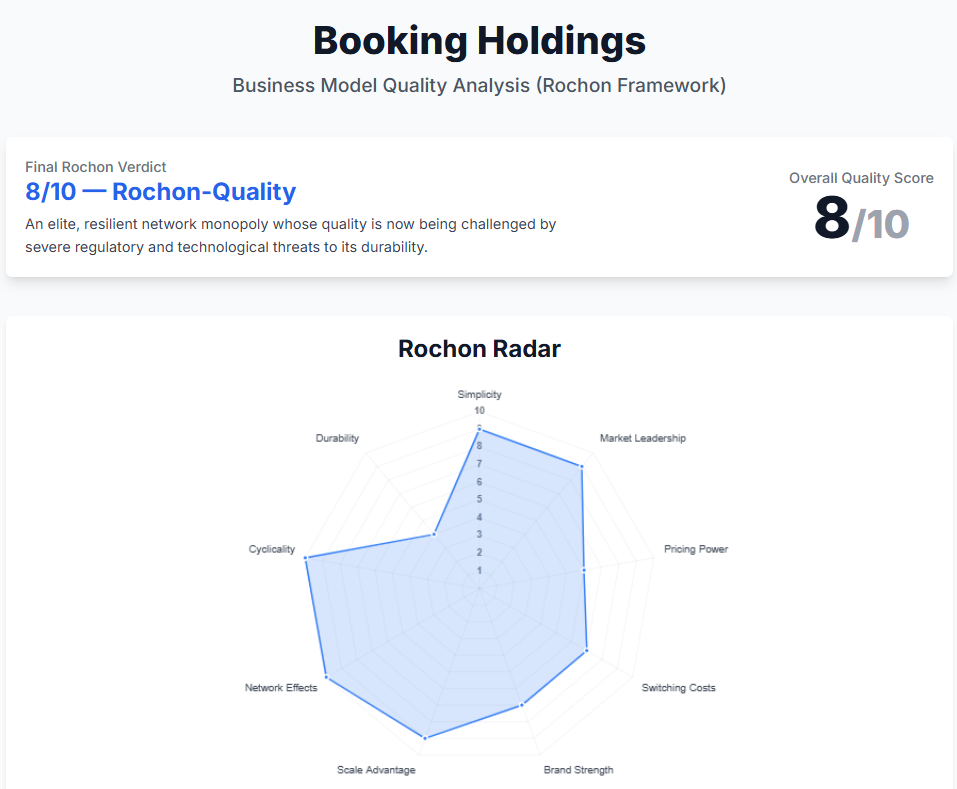

1. TOP SUMMARY

Business Model Quality Score: X/10

(9-10 = elite, durable, simple, leadership + moat; 7-8 = strong; 5-6 = acceptable; 0-4 = weak)

Rochon Verdict: X/10 — Rochon-Quality / Borderline / Not Rochon-Quality

Provide a 1-2 sentence explanation capturing the decisive insight.

ROCHON RADAR (0-10 each, with brief justification)

Use ONLY the definitions below when scoring:

Simplicity

Market Leadership

Pricing Power

Switching Costs

Brand Strength

Scale Advantage

Network Effects (if relevant)

Cyclicality (resilience)

Durability (10-20 years)

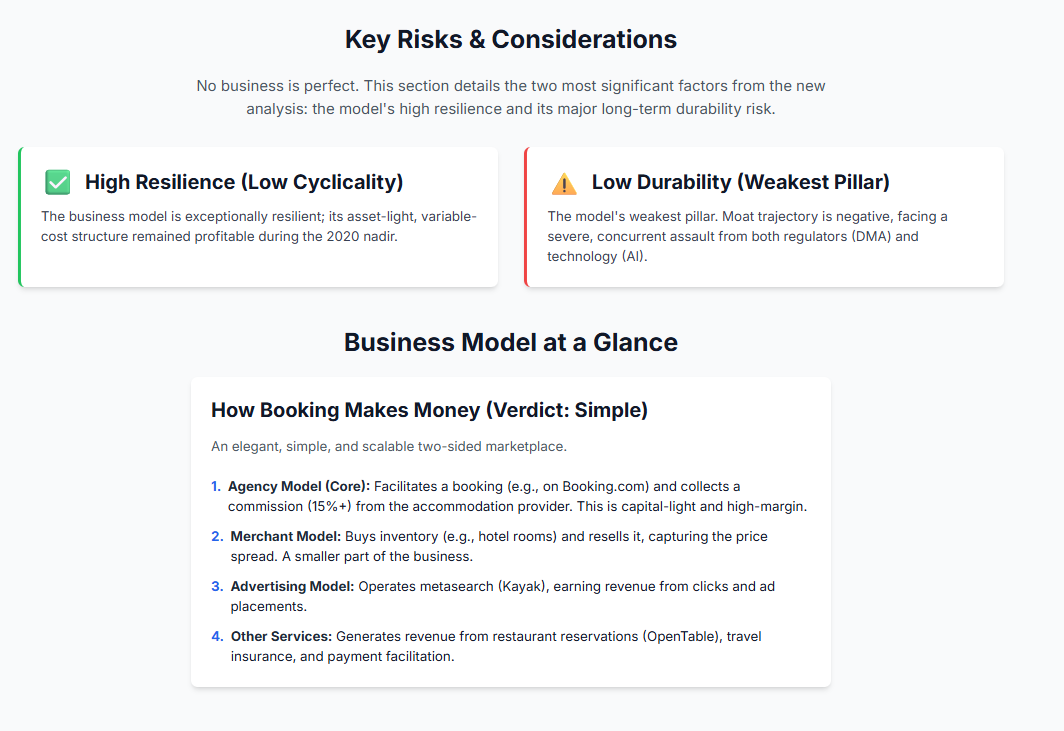

2. FULL ANALYSIS

A) Business Model Simplicity

Summarize how the company makes money (5 bullets max)

Verdict: Simple / Acceptable / Too Complex

Why simplicity matters in Rochon’s framework

B) Market Leadership

Evidence of pricing influence, standard-setting, competitor behaviour, brand/distribution dominance

Rating: High / Medium / Low

C) Competitive Advantages (Moats)

For each moat: Pricing Power, Switching Costs, Brand Strength, Scale Advantage, Network Effects (if relevant)

Rating: Strong / Moderate / Weak

1-2 lines of evidence

Finish with: “Moat Engine Summary: …”

D) Cyclicality (Demand + Earnings + Leverage)

Assess demand stability, earnings behaviour in downturns, qualitative leverage exposure

Rating: Low / Medium / High

E) Durability Outlook (10-20 Years)

Evaluate moat trajectory, industry threats, customer lock-in, regulatory/tech risk

Rating: Strong / Moderate / Weak

FINAL ROCHON VERDICT (MANDATORY)

Business Model Quality Score: X/10

Rochon Verdict: X/10 — (Rochon-Quality / Borderline / Not Rochon-Quality)

One-sentence rationale with the single decisive factor.2. Gemini creates a full research plan.

Gemini will breaks your request down into a structured analysis the same way a real analyst would.

You’ll see:

which documents it plans to open

how it will apply the Rochon criteria

3. It executes the plan.

Gemini starts by expanding the prompt:

“What does ‘Business Model Quality’ mean? What does Rochon focus on?”

Then it pulls insights from 100+ sources automatically:

filings

transcripts

presentations

investor materials

industry reports

expert commentary

(And yes you can exclude sources you don’t trust. Just add it to the prompt.)

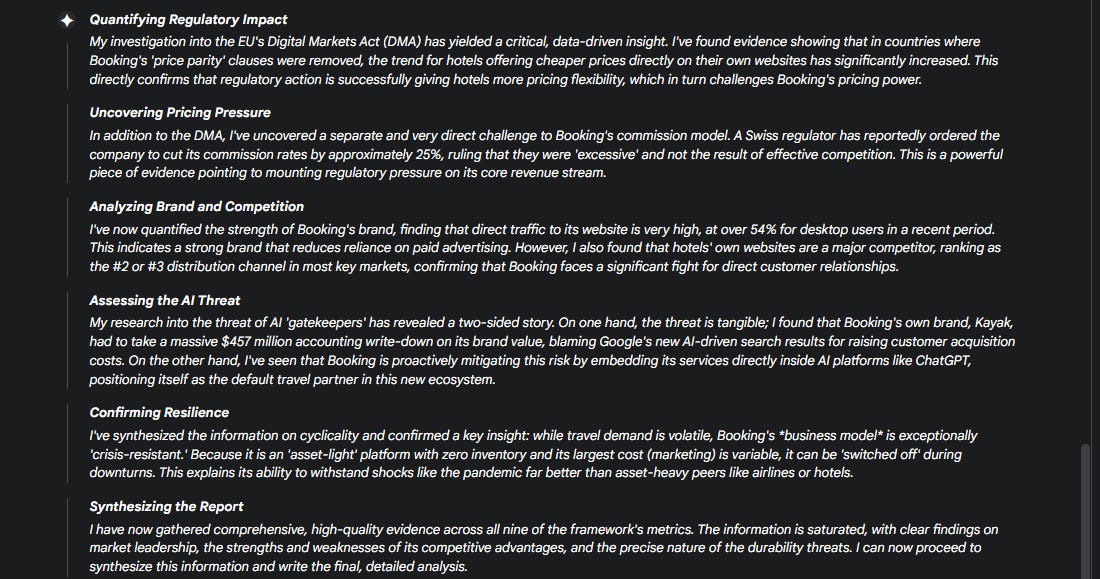

4. It cross-checks everything.

Gemini compares sources, removes contradictions, and organizes all evidence into the exact structure you requested in your prompt.

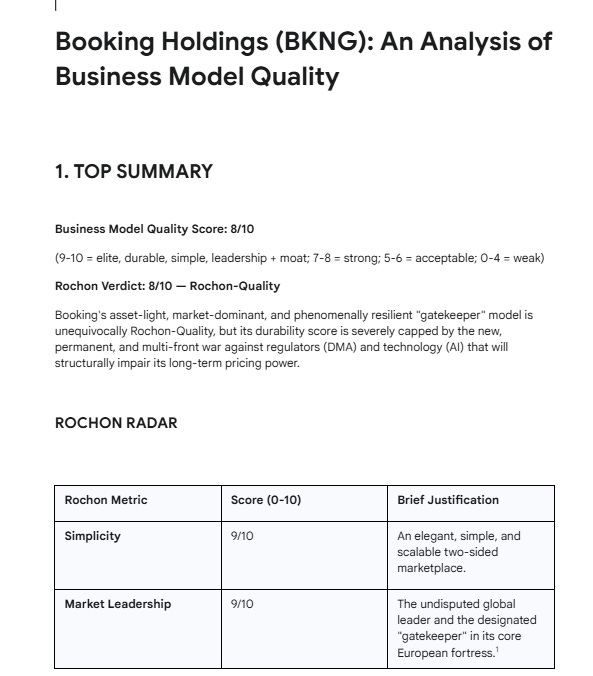

5. It produces a full investor-grade report.

Usually 10–15 pages, with:

a clean Top Summary

a Business Quality Score

a “Rochon Verdict”

and a visual radar chart of the business model

6. Turn it into an interactive webpage.

With one more step, you can convert the full analysis into a clean, interactive dashboard easy to navigate.

Step 2 : Evaluate the Management Team (The Rochon Way)

If you look at how François Rochon studies companies, there’s one thing he believes deeply:

a great business with poor management won’t stay a great business for long.

That’s why after understanding the business model, he goes to the people running it.

He cares about a few things more than anything else:

Are they honest and transparent?

Do they think in decades, not quarters?

Do they own real skin in the game?

Do they allocate capital with discipline?

Do they communicate clearly, without hype?

Do they actually do what they say, year after year?

DeepResearch can read the last 5 years of filings, calls, letters, insider reports, and strategy updates and extract the behavior patterns that matter.

1. Copy the prompt below and change the stock name.