Understand Any Business in 5 Steps (Without Reading 1,000 Pages )

The only workflow you’ll ever need to break down any business

The biggest leverage AI gives you is understanding businesses fast.

Going from “that stock looks cheap” to “I actually get how this company makes money” takes time.

Sometimes hours, sometimes weeks.. depending on the business and the time you have.

With the right prompts and structure, AI cuts that learning curve by 10 X.

Here’s the 5-step workflow I use to go from 0 to clarity on any business with AI:

Step 1: Collect Your Sources

Start with the foundation:

Download the last 5 to 10 annual reports.

Add any Capital Markets Day or Investor Day PDFs if they exist.

That’s usually enough to see how the company evolved and where it stands today.

You’ll find these on the Investor Relations page, but downloading them one by one is slow.

Let ChatGPT do it for you in seconds.

Copy and paste this prompt:

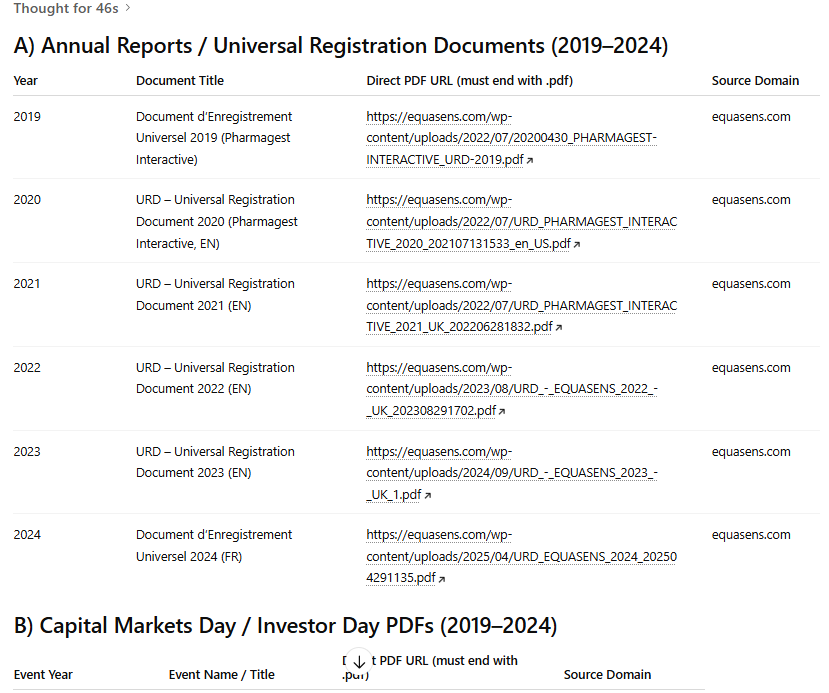

You are a research assistant specialized in retrieving official investor documents.

Goal:

Collect verified, official PDF files for a specific public company.

Company: [Insert Company Name] operating in [Insert Sector]

A) Annual Reports (primary task)

Retrieve only Annual Reports, Form 10-K, or Universal Registration Documents for the exact years 2019, 2020, 2021, 2022, 2023, 2024.

Return only direct downloadable PDF links (URL must end with .pdf).

Sources must be official:

Company investor-relations website

Official regulators (e.g., SEC.gov, AMF-France.org, Companies House, Borsa Italiana, etc.)

Exclude HTML pages, aggregators, press releases, CSR/ESG reports, presentations, or interim results.

If both English and another language exist for the same year, keep only one: English if available, else the original language.

If the company changed names, search prior names to locate older filings.

Return exactly one verified PDF per year, in chronological order.

Output as a clean table with columns:

Year

Document Title

Direct PDF URL (must end with .pdf)

Source Domain

Ensure each link is direct-downloadable (usable with wget or curl).

B) Capital Markets Day / Investor Day (secondary task)

Search for Capital Markets Day or Investor Day materials within 2019–2024.

Accept PDFs only (URLs must end with .pdf). Prefer English; if not available, use the original language.

Sources must be official (company IR site or official exchange/regulator portals).

Exclude non-PDFs, media articles, and third-party summaries.

Output a separate table titled “Capital Markets Day / Investor Day PDFs (2019–2024)” with columns:

Event Year

Event Name / Title

Direct PDF URL (must end with .pdf)

Source Domain

Formatting:

Provide Section A table first (Annual Reports), then Section B table (CMD/Investor Day).

Do not include anything else.

In less than a minute, you’ll have all the official links listed in one clean table.

Just click, download, and upload them :

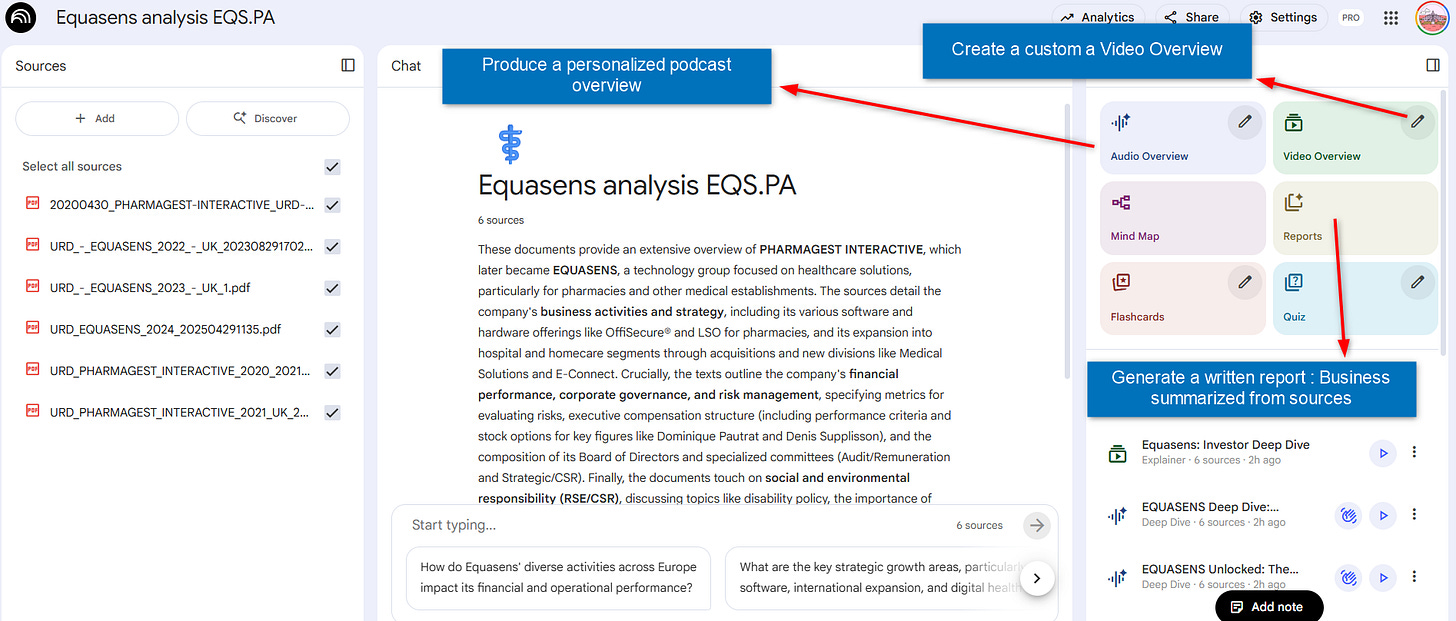

After downloading, upload everything into a new notebook.

That becomes the database for your analysis.

NotebookLM only uses your uploaded files, so every insight stays factual and source-based.

Note: I tested this prompt on 10 stocks using 3 different LLMs.

ChatGPT gave the best results, with an error rate around 3%.

Even if one link fails, downloading it manually is still much faster than doing the whole process by hand.

Step 2 : Get the Big Picture

I always start with a 15 minute overview to quickly understand what the business does and how it makes money.

But everyone learns differently.

Some people read.

Some listen.

And some need moving pictures because their brain refuses to process another paragraph after 6 p.m

The good news?

NotebookLM works for all of us, no matter how we learn:

Create a custom written report that summarizes how the business works.

Generate an audio overview you can listen to while driving or at the gym.

Build a short video walkthrough to visualize how the company makes money.

Pick your format, spend 15 minutes, and you’ll get the kind of clarity that usually takes hours of reading documents.

How to turn 500 pages into a summary you’ll actually Read:

For all my investor friends who love to read, this step is a game changer.

It will generate a high-quality report that replaces hundreds of pages of annual reports.

Let me show you how :