The 23 Principles Every Investor Needs to Master AI

The only framework you’ll ever need.

Most investors use AI wrong.

They ask it to “analyze like Buffett.”

Get a generic answer.

Then say “AI is useless.”

ChatGPT. Gemini. Claude. NotebookLM. Perplexity…

You name it…I have tried them all.

Hundreds of hours testing what actually works.

And here’s the truth:

The difference isn’t in the tools.

It’s in the principles that guide how you use them.

Here are the 23 principles that matter most for mastering AI in investing.

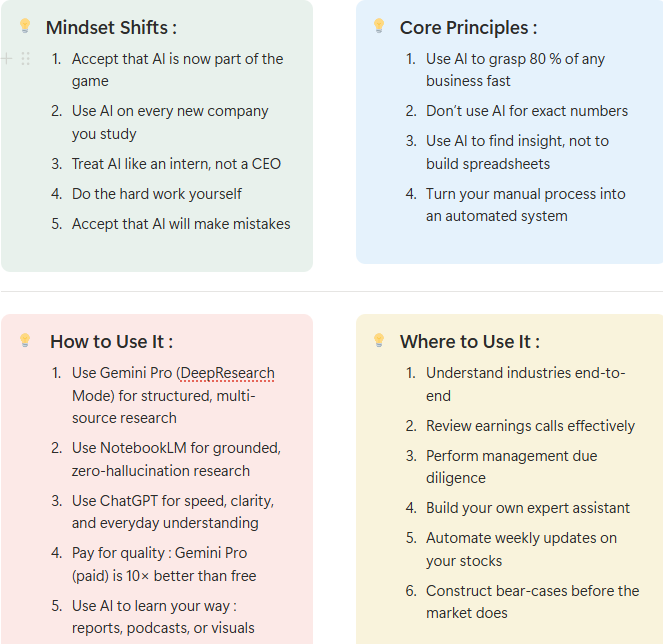

Grouped into 4 parts that build on each other:

Mindset Shifts : Get the Basics Right

Before using AI well, you need the right frame.

These principles reset how you see AI :

Accept that AI is now part of the game:

AI isn’t a trend.

It’s the new baseline for stock research.

Put your ego aside and accept it andIf you can analyze a business in 1 hour instead of 10, you should do it.

Use AI on every new company you study.

Make it the first step in your research process, not an optional shortcut.Treat AI like an intern, not a CEO:

AI can summarize, organize, and explore ideas.

But it can’t replace your judgment.You stay in control of the thinking.

Let AI do the heavy lifting so you can focus on thinking.Do the hard work yourself:

AI is powerful, but it doesn’t replace reading annual reports or doing the real analysis.You still need to understand the numbers, the strategy, and the people behind the business.

Any serious long-term investor already knows this..

Accept that AI will make mistakes:

AI makes mistakes.That’s normal.

Don’t avoid it ,verify what matters.

You don’t stop driving because accidents happen.

You learn to drive better.Same with AI: stay alert, but keep driving.

Practice until it becomes a skill and keep evolving

Using AI is a skill you build by doing, not reading.

The more you use it, the faster you’ll learn to think with it.

AI itself evolves fast , what’s limited today may be possible next quarter.

Stay curious, keep testing, and keep improving how you work.Core Principles : What AI Is (and Isn’t) Good For

Use AI to grasp 80 % of any business fast:

After hundreds of hours testing every use case, this is the one that created the biggest shift in how I invest.

It’s the moment you go from “What’s this stock?” to “I get the business model.”That level of clarity used to take days of reading filings, reports, and presentations.

Now it takes a few hours with AI.Once you understand how a business makes money, you know whether it deserves more of your time or none at all.

Use AI to filter quickly, so you can focus on the few companies that truly matter.Don’t use AI for exact numbers:

Forget DCFs they were barely useful even before AI.

Don’t expect LLM’s to crunch numbers.

They’re not built for that.Focus on understanding how the business makes money, not predicting it to the decimal.

Use AI to find insight, not to build spreadsheets.

Turn your manual process into an automated system:

AI can’t fix a messy process.

If you don’t know how you analyze a business, it can’t know either.Start with a clear checklist:

Business model

Moat

Management quality

Key risks

You need clear steps before AI can turn them into results.

Working With AI: The Core Practices

Use Gemini Pro (DeepResearch Mode) for structured, multi-source research:

After testing every major model across dozens of stocks, this one delivers the most consistent depth.

It connects filings, decks, and industry data to explain how a business works.Use it to study business models, value chains, and long-term growth drivers.

I explain this in detail here : Why DeepSearch Is the Answer ?

Use NotebookLM for grounded, zero-hallucination research:

This is the only LLM that doesn’t invent information.

It answers strictly from the documents you upload :annual reports, transcripts, investor decks or a YouTube video.Use it when accuracy matters more.

Perfect for deep work, validating facts, and building conviction on a stock from your own sources.Use ChatGPT for speed, clarity, and everyday understanding:

It’s the fastest tool to grasp a finance concept or clarify a technical question.

Use it to simplify complex ideas, rephrase dense sections, or check your understanding before going deeper.It’s ideal for quick insights, not full analysis.

Think of it as your on-demand assistant fast, clear, and always available.Pay for quality : Gemini Pro (paid) is 10× better than free:

Start with the free version to test it.

Once you see its potential, upgrade.The paid plan unlocks more DeepResearch, a larger context window, and far better reasoning.

Free tools are fine for curiosity.

Paid tools are for serious research.Use AI to learn in your way : reports, podcasts, or visuals:

Everyone learns differently, and AI makes that easy.If you like reading, let it create a detailed DeepResearch report, 15 pages, full of context.

If you prefer listening, turn that same content into a podcast-style summary.

If you’re visual, have it build a simple one-pager or webpage with charts and key takeaways.Learn the way that works for you. AI adapts.

Master prompting : clarity in, clarity out:

Everything starts with the quality of your prompt.

Clear thinking in = clear output out.Be methodical:

Set the role and context.

Begin with something like “You’re an expert financial analyst.”

It frames how the model should reason.Be ultra-specific.

Avoid vague asks. like “Tell me about this company”Don’t overload it.

Too many requests in one prompt = shallow answers.Keep it concise and focused.

One goal per prompt. Then build from there.

Prompting is a thinking skill the clearer you are, the smarter AI becomes.

Build a prompt library : your best prompts are long-term assets:

Creating a prompt that truly works takes time.

When you find one that gives consistent, high-quality results, save it.Over time, these become your personal research system , a set of reusable frameworks for analyzing companies, industries, or situations.

Don’t start from scratch every time. Build your own library of prompts that compound with time.Use ChatGPT to tailor your master prompts by industry:

For complex businesses, you need more specific questions.

Don’t start from 0.Take a strong master prompt from your library and ask ChatGPT to adapt it to a specific industry.

It will rewrite it for semiconductors, retail, or any niche you choose giving you a sharper, more targeted prompt to run in DeepResearch.

This is the ultimate hack: use AI to customize your own AI prompts.

Where to Use It : High-Impact Use Cases

Understand industries end-to-end :

Map how an industry works :value chains, key players, and economics in one hour instead of weeks.I’ve shared the full 5-step process here →

Review earnings calls effectively:

Compare tone and message vs last quarter.

Spot what changed in tone, priorities, or guidance since the last quarter.Management due diligence.

Spot patterns in interviews and shareholder letters.Build your own expert assistant:

Use NotebookLM to create your own AI analyst for any industry.

Upload filings, decks, and transcripts.

It answers your questions with context and accuracy.

I explain the full process step by step here:

Automate weekly updates on your stocks :

Set up workflows that run every week and send you the latest insights automatically.

Gemini can pull new articles, filings, and news about a specific company, sector, or your entire portfolio.You’ll get fresh updates on schedule without searching manually.

Bear-case construction:

Let AI destroy your thesis before the market does.Use AI to learn faster:

Ask it to explain any concept you find in a financial report from accounting terms to business metrics.

Start simple, then go deeper until you fully understand it.

The list could go on forever. These are just a few to get you started.

Recap:

These 23 principles work together to help you master AI in investing:

Mindset Shifts : Build the right foundation.

Core Principles : Focus where AI truly adds value.

Working With AI: Apply the right tools, prompts, and workflows.

High-Impact Use Cases :Turn theory into action.

Master these 4 layers, and you’ll operate on a different level in how you use AI for investing

Great analysis! Thanks for sharing!

Brilliant analysis! It's so true how people blame the tools instead of their approach. Treating AI like an intern who needs clear tasks is spot on. How do you suggest investors overcome the initial ego hurdle to truly embrace AI as a first step? This piece truly insightful.